Longer lives, longer careers?

Poorer health, coupled with rising medical inflation, could be the spanner in the works

WITH news recently of government and employers recalibrating what "retirement age" really means in the context of Industry 4.0, there is still one nagging question that older workers are asking: "Will I run out of money before I run out of life?" Thankfully, with the new measures in place, the stigma of not being able to provide for oneself or stay financially independent till the age of 70 is now consigned to the past. But for older workers, there is just one catch to having a longer work horizon: they need to stay healthy in order to enjoy the benefits. And sobering statistics reveal that while life expectancies are firmly on the rise, a good decade of that longer life is likely to be spent in ill health, resulting in higher medical costs.

At his National Day Rally on Aug 18, Prime Minister Lee Hsien Loong announced that the government had accepted the recommendations of the Tripartite Workgroup on Older Workers to raise the retirement and re-employment ages. The retirement age will go up from 62 to 63 in 2022, and eventually to 65 by 2030. The re-employment age will also rise from 67 to 68 in 2022, and eventually to 70 by 2030. Central Provident Fund (CPF) contribution rates will also go up over the next 10 years or so for workers aged 55 to 70.

In this much welcomed paradigm shift, older Singaporean workers whose incomes are in the middle of their cohort will benefit the most from being able to work longer and have more retirement savings over the next 10 years, based on calculations by NUS economist Chia Ngee Choon. Associate professor Chia said last week that the new CPF contribution rates will enhance the CPF Life annuity payout of median-income earners by close to 22 per cent in 2030.

Also, while there has been a lot of talk about jobs being consumed by ravenous robots in the New Economy, and that the older generation have to make way for the younger of the species, in real life around the world, that is not happening in every quarter. The perennial problems of retiring baby boomers and falling birth rates in many countries are presenting serious skills shortages for businesses. Millennials, once the blue-eyed boys and girls of the digital economy, are today finding it hard to secure full-time work while some prefer to go the gig way.

More companies globally, from financial institutions to fintech to startups, are already tapping the wisdom and institutional memory of older workers by offering them reskilled roles, part-time pack ages and flexi-work arrangements.

Also, there's more evidence now that points to better health for those who keep on working. Workers who postpone retirement are less likely to develop Alzheimer's disease and other forms of dementia, than those who leave their jobs at age 60, a recent survey of nearly half a million European retirees shows.

A government study in France, in which the health and insurance records of more than 429,000 former workers were examined, found that the risk of developing dementia declined with each additional year worked beyond an average retirement age. Further, there was a 14 per cent reduction in Alzheimer's detection in workers who retired at 65 over those who retired at 60.

Alzheimer's, the most common form of dementia, is the sixth leading cause of death in the US, according to the Alzheimer's Association website. About 5.2 million Americans currently live with the disease, with 5 million over the age of 65 diagnosed with Alzheimer's and 200,000 suffering from a younger-onset form of the disease.

Battling poor health

For older Singaporeans, longer may not translate to healthier lives in the future, given statistical findings from the Global Burden of Disease (GBD 2017) study. Between 1990 and 2017, while overall life expectancy at birth in Singapore rose 8.7 years to 84.8 years, a healthy life expectancy at birth rose only 7.2 years, to 74.2 years.

This means that even though Singaporeans gained 8.7 years in life expectancy, about 10 years of our lives will be spent in ill health. The Ministry of Health produced a separate report on the burden of disease in Singapore, in collaboration with the Institute for Health Metrics and Evaluation of the University of Washington.

The sobering fact is that the goal of longer life expectancies and less time spent living with an illness has yet to be achieved consistently by any country today, according to the study. Among a comparison group of peer locations composed of Hong Kong and the member nations of the Organisation for Economic Co-operation and Development (OECD), Singapore had a lower incidence of people living in ill health and disability in general - measured as a significantly lower-than-average rate of age standardised disability-adjusted life years (DALYs) in nine of Singapore's 10 leading causes of early death and disability.

However it had significantly higher-than-average rates of DALYs due to lower respiratory infections and tuberculosis, a category that includes pneumonia. Compared to its peer countries in 2017, Singapore had significantly lower-than-average rates of age-standardised DALYs attributable to eight of the 10 leading risk factors affecting health in Singapore.

The top killers

The good news is that Singaporeans are now less likely to be headed for an early death. But while the burden of early death, measured in Years of Life Lost (YLLs) has declined, the rates at which Singaporeans experience ill health, measured in years lived with disability (YLDs) have remained relatively constant over time.

This indicates that Singapore, like most countries, has not been as successful in preventing ill health as it has been in preventing early death, the GBD report shows.

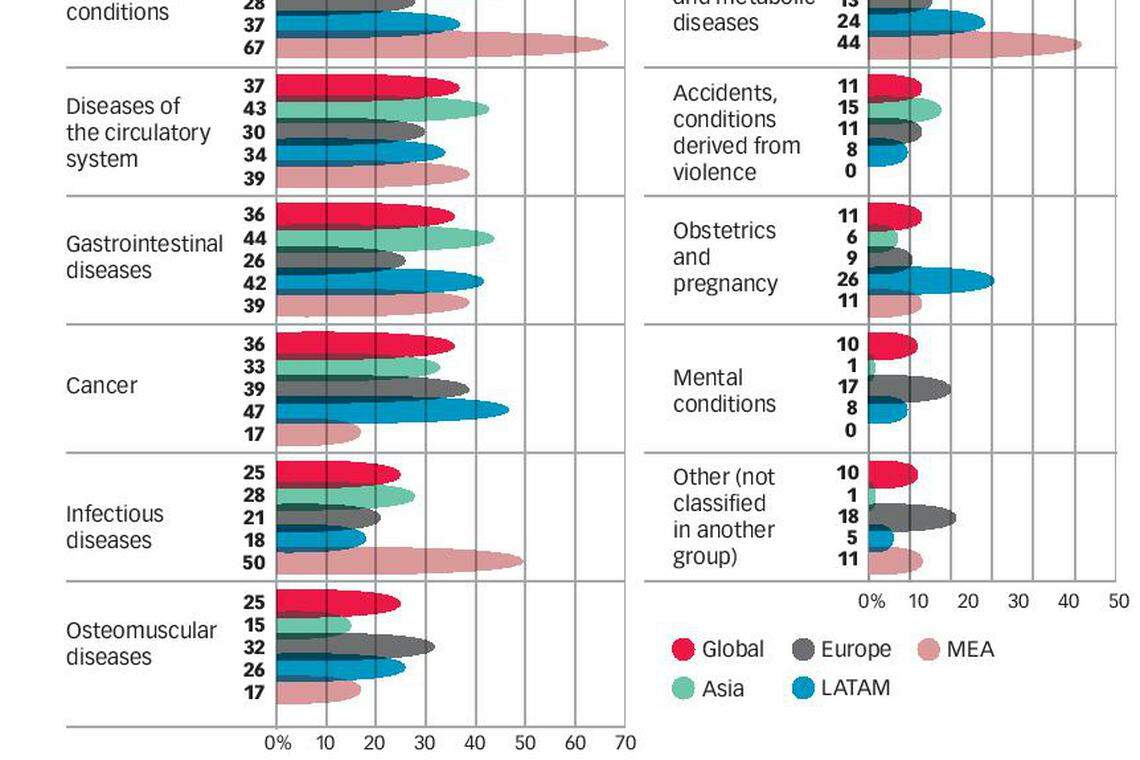

The largest contributors to Singapore's combined burden of early death and disability, measured in DALYs, were cardiovascular diseases (14.2 per cent of total DALYs), cancers (13.3 per cent), musculoskeletal disorders (12.6 per cent), and mental disorders (10.2 per cent).

Also, the causes of DALYs that showed the largest increases between 1990 and 2017 were sense organ diseases, such as hearing loss and vision impairments (which increased in number of DALYs by 124.5 per cent), neurological disorders, which include Alzheimer's disease and other dementias (which doubled), and musculoskeletal disorders (which also doubled). The report states that all of these increases were driven mainly by Singapore's ageing population.

The three top killers, when combined, accounted for approximately 70 per cent of Singapore's Years of Lives Lost: cancers (31.8 per cent of total YLLs), cardiovascular diseases (28.5 per cent), and lower respiratory infections, which includes pneumonia (10.1 per cent).

The main causes of ill health in Singapore, measured in years lived with disability (YLDs), were non-communicable diseases. Leading causes were little changed over time - in both 1990 and 2017, the four leading causes of YLDs were, in order, musculoskeletal disorders (which caused 20.7 per cent of YLDs in 2017), mental disorders (17 per cent), unintentional injuries (8.7 per cent), and neurological disorders (7.7 per cent).

Leading risk factors affecting health in Singapore in 2017 were dietary risks, tobacco, high blood pressure, and high blood sugar. Between 1990 and 2017, excess weight and obesity rose from Singapore's eighth leading risk factor to its fifth, and caused a 141 per cent jump in the number of years of healthy life lost to premature death and disability.

Challenges of medical inflation

Complicating the issue of ill health is another worrying trend - rising medical inflation. According to the Mercer Marsh Benefits 2019 Medical Trends Around the World report, Singapore's medical cost inflation rose 10 per cent last year, 10 times more than the Singapore economy's estimated 2018 inflation rate of one per cent. Headline inflation was only 0.4 per cent.

The possible factors cited were overuse of insurance and doctors in private practice charging higher rates. The study showed that Singapore's medical inflation is partially driven up by supplier-led factors such as expensive pharmaceuticals and biologics.

Singapore came in at No 6 of 11 Asian countries surveyed. Its 10.0 per cent increase was slightly lower than the Asian average of 10.4 per cent. The bad news is that medical inflation is expected to notch 10.1 per cent by the end of 2019. Experts also point to increasing affluence coupled with a longer lifespan as leading to Singaporeans apportioning more of their disposable incomes to healthcare.

The Report of the Tripartite Workgroup on Older Workers, however, seeks to turn Singapore's ageing population into an opportunity for growth, and is confident of addressing the economic and social challenges of its recommendations. Already, 63 per cent of insurers today are helping their members make savvier healthcare-related decisions to stay out of the hospital, says the Mercer report. Insurers are providing education, tools and incentives to drive positive behaviour. Globally, 78 per cent of insurers say they are considering or already support virtual health consultations such as via mobile devices.

Preventative healthcare

One of Singapore's largest international insurers, Prudential, has been keeping a close eye on the employability of older workers in Singapore and has specially tailored programmes to meet the needs of this cohort.

Says chief executive Wilf Blackburn: "We are indeed seeing healthcare costs increasing in Singapore. Even though Singaporeans have the highest life expectancy in the world, they are not living healthily. The number of older adults who develop more than one chronic condition - called multi-morbidity - has been growing, with more than half of Singapore's residents who are older than 60 falling into this category today.

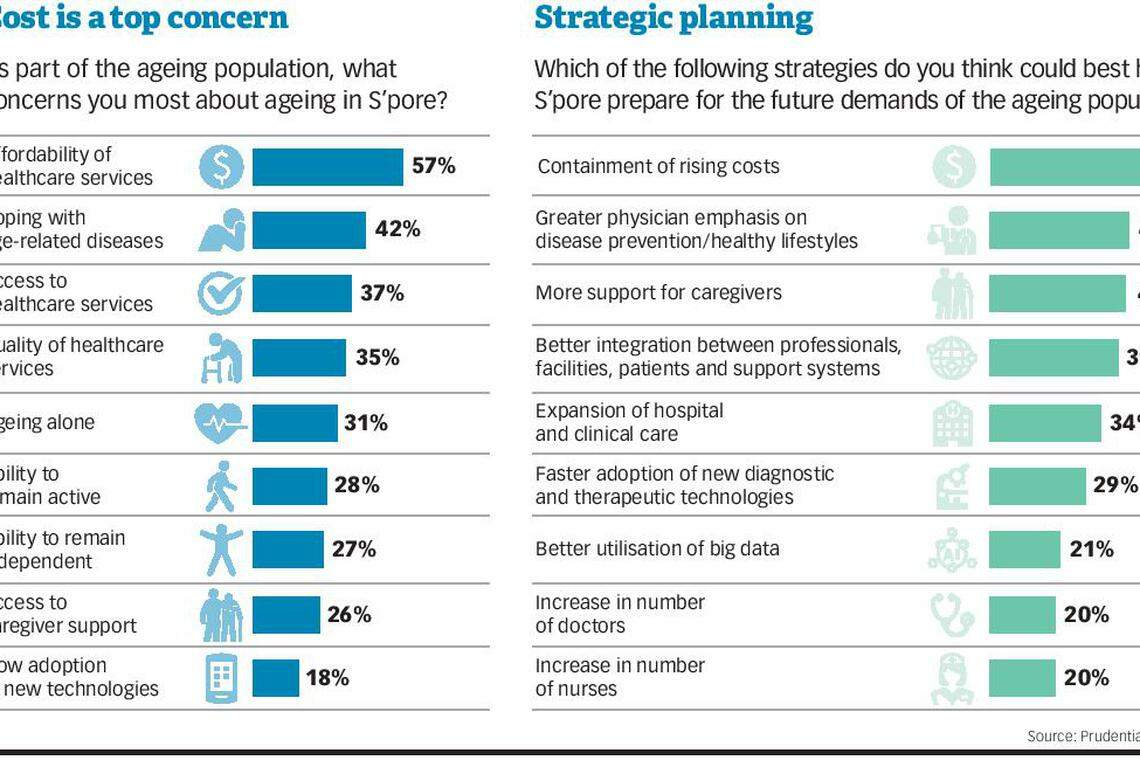

"This is leading to an increase in medical costs, which will be the biggest concern for Singaporeans as they age, according to Prudential's Healthy for 100? Healthy Care in Singapore survey. Nearly half of the healthcare practitioners (49 per cent) surveyed in the report also say that Singaporeans will be unprepared for the health-related expenses of living to 100," he says.

To keep costs in check and the population healthier for longer, healthcare practitioners interviewed for its Healthy for 100 study advocate preventative healthcare as a key strategy.

"With preventative care, people can take proactive steps to lead a healthy lifestyle and prevent disease or postpone its onset when they get older," says Mr Blackburn.

He shares that eight in 10 of the healthcare practitioners surveyed said the healthcare system must place more emphasis on disease prevention, and nearly as many (70 per cent) said individuals need to be responsible for supporting their own healthy ageing.

"As medical costs continue to rise, we must evaluate the role we can play in making healthcare more affordable and accessible," says Mr Blackburn. "As insurers, this means changing the way we engage with customers. We want to go beyond covering their medical bills to coming up with innovative solutions that can help them live well for longer. Staying healthy is the best strategy to keep one's medical expenses low in the long run," said Mr Blackburn.

And yet, when it comes to action, it is the young - more than half of Singaporeans aged between 25 and 45 - who are not taking the initiative to proactively prevent common chronic conditions such as diabetes and heart disease, the Prudential Healthy for 100 survey revealed.

This is because younger respondents feel there is no urgency to prevent age-related diseases as they believe it is something that would impact them only 40 to 50 years later.

Prudential says another factor could be the "knowledge-practice" gap. People know in principle what is good for them but when it comes to action, they fall short. Take sugar consumption for instance.

Changing this mindset towards proactive healthy living from young will require a multi-pronged effort. Not just the government and healthcare practitioners, but individuals and businesses must do their part, says Mr Blackburn.

Insurers like Prudential are moving away from the traditional model where they underwrite a life, collect a premium and pay for treatment when the person falls sick.

Technology is a big part of the preventative healthcare solution. In Prudential's Healthy for 100 survey, 77 per cent of the respondents say that greater investment in at-home technologies to support chronic disease care will be needed as the populations age - and it is these technologies that will help individuals manage their health better, and keep insurance costs down.

Sidharth Kachroo, head of medical portfolio management, Prudential Singapore, says one needs to start young on preventative healthcare. "The earlier we start taking care of our well-being by keeping to a good diet and lifestyle, the higher our chances of ageing well. After all, good health is earned - not given."

Prudential is currently collaborating with various technology partners to build a digital health ecosystem for clients. This solution will have a symptom checker, allow for virtual doctor consultations and offer fitness challenges. It will help detect diseases earlier, intervene at the right time, and promote overall healthy living.

The company has also introduced "claims-based pricing" to encourage consumers to live healthier and be prudent with how they use healthcare services. With this pricing approach, customers who claim less, pay less. In addition, customers who do not make claims during the review period, enjoy a 20 per cent PRUwell Reward on their premiums.

AIA, meanwhile, earlier this year sealed a deal with WhiteCoat, for the startup to be the exclusive telehealth provider for its corporate client base of 1.2 million employees and their dependants.

WhiteCoat will provide AIA's corporate base on-demand access to qualified doctors via a smartphone app, offering a seamless service covering diagnosis, treatment, medical referrals and delivery of medicines straight to their doorstep.

The deal is also expected to make the claims process seamless, with automated billing at the back-end so users will not need to fork out cash and seek reimbursement.

Government help for low-income seniors

For the elderly cohort unable to afford insurance, there is help from the government.

Minister for Manpower and Second Minister for Home Affairs Josephine Teo has reiterated that Singapore's social security is not just dependent on CPF, citing home ownership, the Workfare Income Supplement for older low-wage workers and Silver Support, which gives cash to low-income elderly citizens. There is also Pioneer Generation and Merdeka Generation packages, and the Community Health Assist Scheme (CHAS).

The Ministry of Manpower (MOM) has also in place several programmes to help Singaporeans cope with longer lifespans. MOM rolled out WorkPro, which funds companies' adoption of progressive practices, such as job redesign and flexible work arrangements. In addition, the Special Employment Credit provides wage support to encourage bosses to employ Singaporean employees aged above 55 years and earning up to S$4,000 a month.

The Housing and Development Board's (HDB's) Lease Buyback Scheme also offers home-owning seniors a way to unlock value. Seniors can continue to live in their HDB homes and receive cash and higher CPF Life payouts in return for the extra years of lease that they are unlikely to need.

While there is no easy solution to the myriad challenges of having the longest life expectancy on the planet, thankfully, there is a growing collective will to enshrine the dignity of ageing gracefully - and graciously - in Singapore.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Features

Nuclear power debate heats up in South-east Asia

Jurong Island: In search of a new miracle

Stay awhile: How long-stay serviced apartments may change the housing landscape

This was village life in Britain 3,000 years ago

‘The genie’s out of the bottle’: When AI meets politics

Job-hopping: Path to success or red flag?