Singapore's palm-oil plays endure a sullen month

But there's a silver lining in biodiesel push by Indonesia and Malaysia, and in China's demand for it

Singapore

THE agri-plays on the Singapore bourse have lost some sheen this eventful month, with the chief culprits being operational headwinds - weak commodity prices and Indonesia's dry spell - and less so the recent move by the European Union (EU) to hit Indonesia, the world's top palm oil producer, with biodiesel levies.

As far as the Western bloc's move goes, analysts are banking on two factors to neutralise its impact: one is the biodiesel push by giant producers Indonesia and Malaysia, and the other, China's rising appetite for the edible oil as it seeks an alternative for soybean oil amid its tariff war with the United States.

OCBC Bank economist Howie Lee, on the EU's move to escalate its anti palm-oil spat with Indonesia through the levies, said: "The potential large-scale switching of soy oil to palm and other vegetable oils by Chinese buyers, in light of the US-China trade war, should help to offset the loss in near-term demand."

Stephen Innes, managing partner of Valour Markets Singapore, describing the EU's decision to impose biodiesel levies as a "trendy movement" that is intensifying as the Amazon rainforests burn, said: "It reinforces my view that the global markets will continue to weaponise trade and tariffs for political, self-serving means."

But relief likely washed over South-east Asia last week when Indonesia, the region's biggest economy, backed away from imposing retaliatory tariffs on EU dairy products.

OCBC's Mr Lee said: "Indonesia's decision to not retaliate means one less trade war in the world today."

Analysts also seem less concerned over the EU's levies because they are banking on Indonesia's aggressive biodiesel agenda to do double-duty - tackle its current account deficit and drive demand for crude palm oil (CPO) at home.

DBS Research said: "Biodiesel can be a game changer if executed well."

Indonesia's President Joko Widodo, whose inauguration into his second term of office takes place in October, has pushed stakeholders to speed up the mandatory proportion of diesel blended with CPO from 20 (B20) to 30 per cent (B30) by January, and to 50 per cent (B50) by end-2020.

DBS estimates that the shift can generate an additional 15 million metric tonnes (mt) of palm oil demand, which forms around a quarter of global demand. The benefits go beyond stronger CPO prices, as B30-B50 can set the stage for CPO prices to decouple from prices of soybean oil, to which CPO has historically been trading at a discount.

Even so, it may be tough to be upbeat based on the recent showing of some of the listed oil-majors:

First Resources, for example, reported a halving of its second-quarter net profit due to weak CPO prices. A week ago, it hit a year's low at S$1.49 and has lost 4.5 per cent so far this month.

The palm oil producer had earlier warned that EU's new biodiesel taxes could hurt its downstream margins. RHB Research said this would essentially reduce its biodiesel capacity utilisation by some 30 per cent, given that about a third of its output is currently exported.

Indonesia's prolonged drought, part of a mild El Niño, is hurting the yield at Golden Agri-Resources (GAR). It posted a second-quarter net loss and recently told analysts that it was lowering its full-year production guidance.

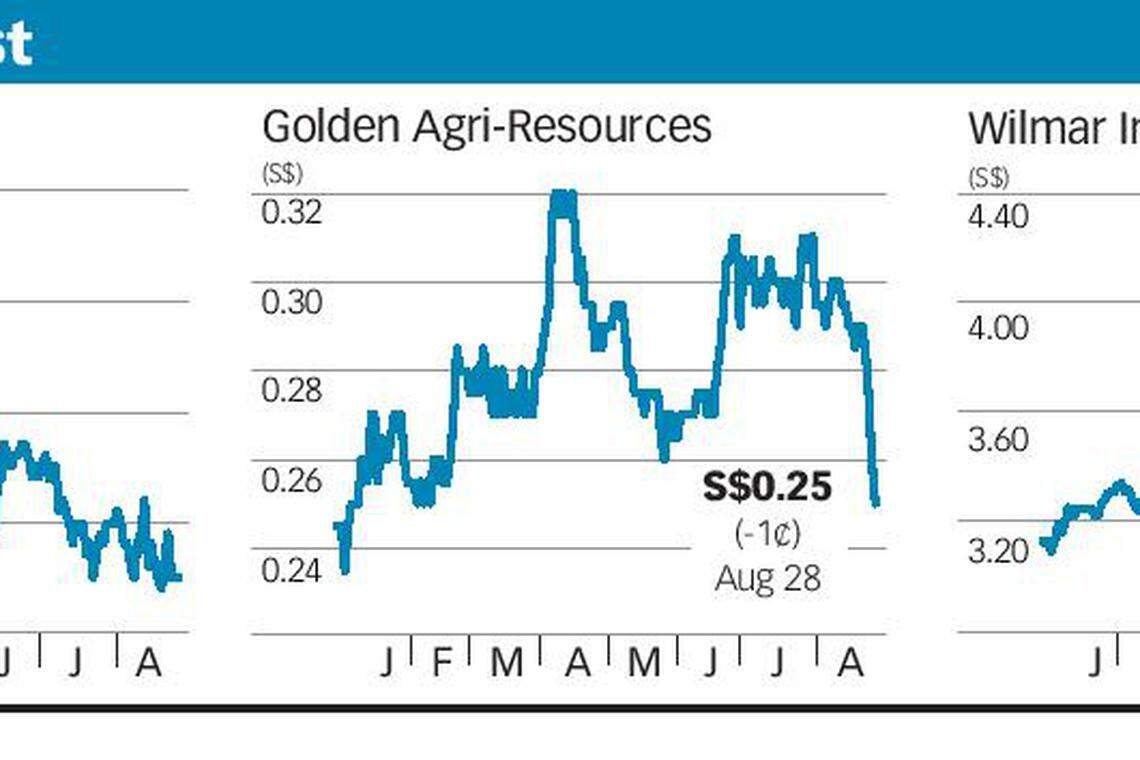

GAR's stock has slipped 15 per cent this month. On Wednesday, it closed nearly 4 per cent lower, at 25 Singapore cents.

This week, Reuters reported that India, the world's biggest edible oil importer, has proposed an additional 5 per cent duty on Malaysian palm oil for six months.

CGS CIMB Research said: "We are negative on this development, as it is likely to erode Malaysian palm oil refiners' competitiveness against that of its Indonesian and Indian peers."

The research house said, however, that although this could hurt Malaysian palm-oil refiners, including Singapore-listed Wilmar International, the impact on Wilmar could be blunted by its exposure to 50 per cent-owned Indian refiner Adani-Wilmar.

Wilmar's imminent listing of its China operations is also likely to keep the commodity giant in analysts' favourite bucket, although this week's global stock rout as the US-China trade feud flared up has so far shaved 7 per cent off the counter this month.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Energy & Commodities

China's Sinopec charts global expansion with refinery in rival India's backyard

Gold trades in tight range as market focuses on US economic data

Anglo American says it received unsolicited buyout proposal from BHP

Oil settles lower as US business activity cools, concerns over Middle East ease

Orsted says Taiwan wind project to power TSMC on track for 2025 finish

Gold edges down as Middle East worries ebb