Asia-Pacific’s top companies need to address crucial gaps in sustainability reporting

As the push towards net zero intensifies, top companies in Asia still aren’t investing the efforts needed to attain such aims. Only half have articulated net-zero targets, while two-thirds of board directors and management have yet to undergo some form of sustainability training.

These were among the key findings of a study released by PwC and NUS Business School on Tuesday (Jun 6), during Ecosperity Week. It analysed the sustainability reports of the top 50 listed companies by market capitalisation in 14 jurisdictions – Australia, China, Hong Kong, India, Indonesia, Japan, South Korea, Malaysia, New Zealand, the Philippines, Singapore, Taiwan, Thailand and Vietnam.

“The study highlights both the progress and gaps in corporate sustainability reporting across the Asia-Pacific region,” said Professor Lawrence Loh, director, Centre for Governance and Sustainability at NUS Business School. “It is crucial to remain vigilant about critical gaps such as net-zero targets, transparency in emissions reporting and sustainability training.”

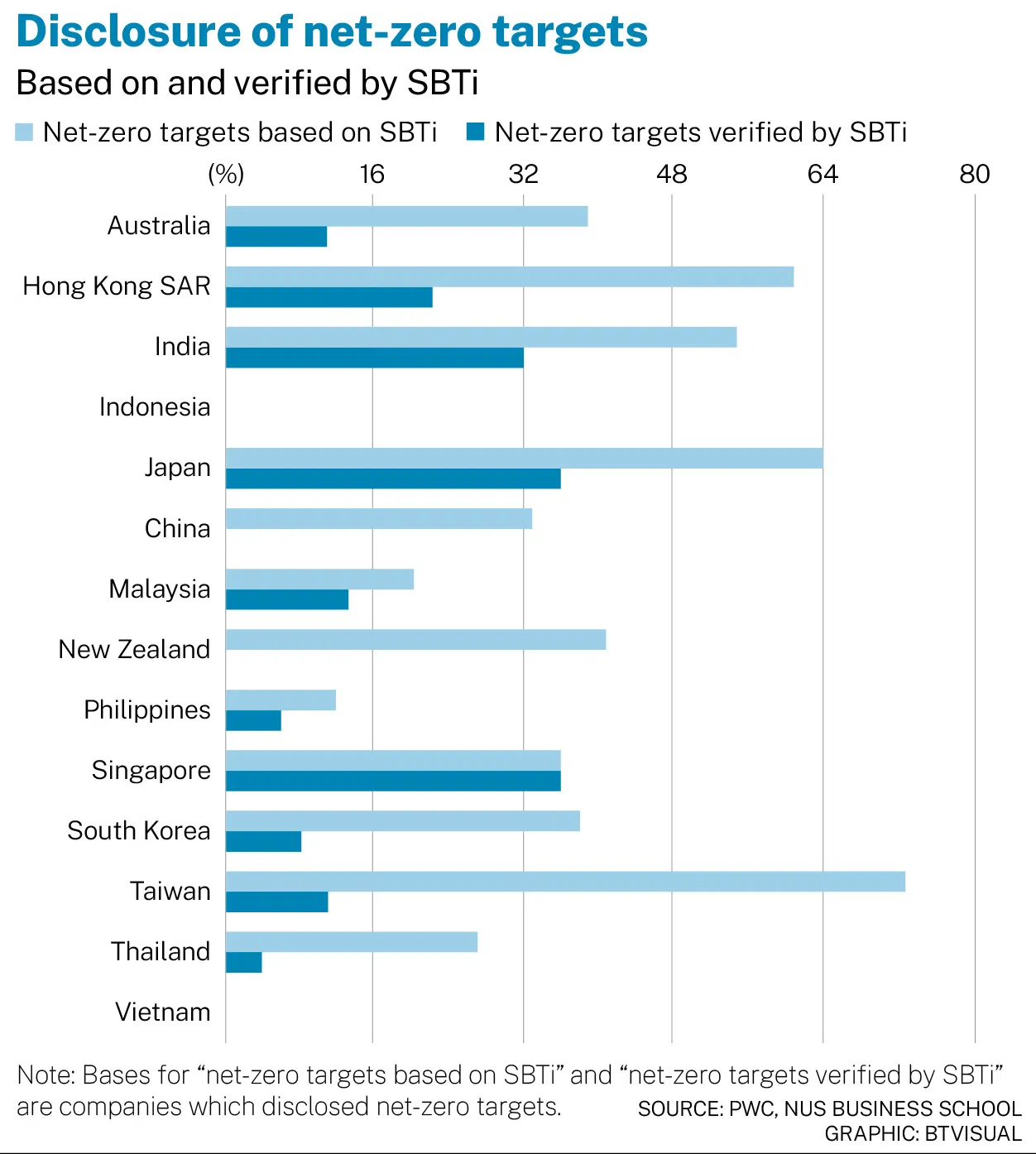

The report, Sustainability Counts II: Sustainability Reporting in Asia Pacific found that, while nine in 10 of the companies had environmental, social and governance (ESG) targets, only half of them (51 per cent) disclosed net-zero targets. And, even fewer (42 per cent) had net-zero targets based on the Science-Based Targets initiative (SBTi) framework.

Less than one-fifth (16 per cent) reported having their targets verified by SBTi – which the report said is important for companies to demonstrate that they have in place a science-based pathway for their business to reach net zero.

There was an overall increase in companies’ disclosure of identified climate-related risks and/or opportunities in their sustainability reporting – from 77 per cent in 2021, to 88 per cent in 2022. This was attributed to the increased adoption of the Task Force on Climate-Related Financial Disclosures framework, where the disclosure of integrating climate-related risks into overall risk management is one of the reporting components.

A NEWSLETTER FOR YOU

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

Companies covered were also found to have increasingly readjusted their business strategies and models to mitigate current climate issues and evolving stakeholder and regulator expectations, compared with a year ago.

Four in five companies disclosed their Scope 1 and 2 greenhouse-gas emissions – suggesting that measurement of Scope 1 and 2 emissions is reaching maturity, the report said. Scope 1 refers to direct emissions from company-owned and controlled resources, while Scope 2 covers indirect emissions generated by purchased energy.

Most companies in the region – except Japan, however, need better completeness in their Scope 3 emissions measurement. Only 50 per cent of companies disclosed their Scope 3 emissions, which are indirect emissions from a company’s value chain; and, of these, only 5 per cent said they carried out a comprehensive level of disclosure, which the report said is essential for a fuller picture of a company’s carbon emissions and influencing change across its value chain.

Sustainability upskilling for board and management remains low. Only about one-third (36 per cent) of companies said their board of directors or management has attended or received sustainability training in 2022. That is up from 24 per cent in 2021.

While some progress has been made, the report said, the low rate of training points to the need for sustainability upskilling at the leadership level, so that directors and management can effectively carry out their roles in overseeing their company’s sustainability strategy, progress and governance.

External assurance of ESG disclosures has been getting more popular – with 49 per cent of companies opting for this, up from 37 per cent the year before.

Companies will, however, need to keep an eye on the evolving sustainability reporting landscape, including developing reporting standards and frameworks.

Fang Eu-Lin, sustainability and climate change leader, PwC Singapore, said: “The challenges businesses face around the interoperability of key sustainability reporting standards, and across multiple jurisdictions, will require companies to develop a strategic road map and an operationalisation plan, while prioritising assurance in sustainability reporting to address rising expectations from investors and stakeholders.”

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

ESG

Family businesses must lead the way in sustainability: TPC’s Chavalit Frederick Tsao

Australia grants feasibility licences for offshore wind farms

Asset owners can’t afford to sidestep sustainability

US reforms green law to speed clean energy, infrastructure permits

Singapore’s chance to become a global leader in sustainable aviation fuel

Temasek Trust launches advisory and management services initiative