Higher rates have hurt returns on renewable energy assets

AS renewable energy has matured as an asset class, investment strategies have split into two distinct approaches.

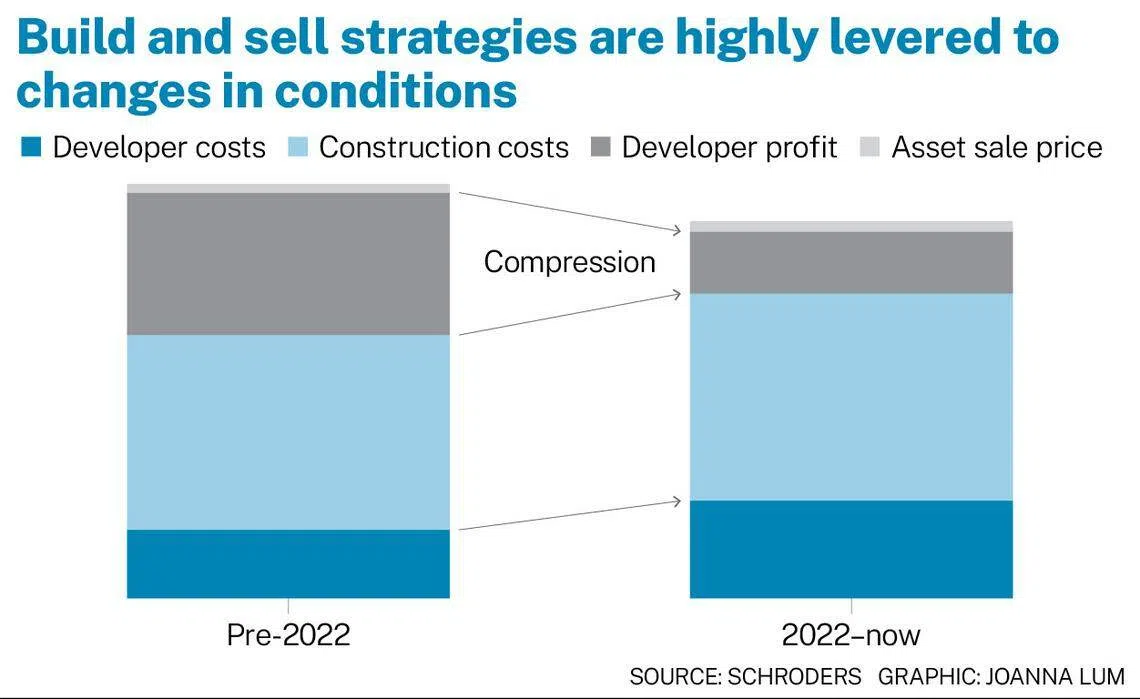

These can broadly be bucketed into shorter-term “build and sell” strategies focused on delivering capital gains, or the longer-term “buy and hold” approach where returns are delivered through income.

These two strategies have a symbiotic relationship, with each requiring a healthy and robust other. Importantly, they offer investors different risk profiles.

“Buy and hold” investors have an uncontaminated exposure to the fundamentals of renewable energy investing, offering access to key return drivers such as inflation, power prices, resource and operational risk.

“Build and sell” investors have access to the same return drivers, but in a more concentrated way. Return outcomes are amplified by exposure to discount rate movements and adoption of leverage, both of which increase the “build and sell” investor’s sensitivity to the interest rate cycle.

The difference in sensitivity to key drivers has become increasingly apparent over recent years. In a falling interest rate environment, the ”build and sell” approach enjoyed strong tailwinds. As interest rates compressed, project values generally increased and therefore the ”build and sell” approach materially outperformed the lower-risk approach.

A NEWSLETTER FOR YOU

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

In a climate of rising interest rates, however, “buy and hold” investors enjoy stronger valuations. Where inflation is a contributing factor to the increase in interest rates, owners of operational assets are protected as their inflation-linked cash flows increase in tandem with interest rates.

The key question for investors looking at the market today is what the future holds, and how to price the risks in both “build and sell” and “buy and hold” investments.

The valuation dynamics of a ‘buy and hold’ approach

An operational renewable energy asset is reasonably easy to value with few key drivers. The asset produces electricity at a rate that can be estimated relatively accurately over the longer term.

This is sold either through fixed-price contracts or through the wholesale power market. Operating costs are typically fixed and comprise a relatively low proportion of revenues (perhaps 25 to 30 per cent).

The resulting free cash flows are discounted to get a value. The main risks are the expected energy yield of the asset (such as changes in operational efficiency or weather risk), and the price obtained for the electricity (driven by such macro factors as power prices and inflation).

These factors are included within the discount rate formulation, which is generally considered as a premium to a risk-free rate and therefore has some level (at least over longer periods) of interest rate sensitivity.

The valuation dynamics of a ‘build and sell�’ approach

The economics of a “build and sell” strategy have more parameters, but are also relatively easy to understand.

First, an estimate of how much it costs to develop and build a specific asset is required. The same calculation as above is then undertaken to estimate how much the asset can be sold for.

The difference between these two figures is the “development premium” – which is at risk due to uncertainties about both sides of this equation, and accentuated by the time frames involved in bringing assets through construction and then selling them into the market.

For development-centred strategies, these risks include securing land, planning, grid connection and a route to market to sell power.

For example, a typical offshore wind farm has a development period of about seven years from initial conception to the start of construction, followed by a further two years of construction.

These risks are generally binary, but are all unavoidable in order to construct and then sell the project once operational.

There is an inherent conflict between the returns of ��”build and sell” and the “buy and hold” investors. Ultimately, the split between project economics for each approach is a zero-sum game.

The actual relationship between the two, however, is nuanced. What matters to “buy and hold” investors is the actual discount rate at purchase, while for the “build and sell” investor the most important aspect is the directional change of discount rates over their hold period of the asset.

The 2010s vintages of “build and sell” saw favourable conditions. A maturing supply chain meant that build cost reduced consistently, while falling interest rates and increasing acceptance of renewables as an asset class meant that the buyers of high-quality operational assets were generally willing to pay more for those assets over time.

These tailwinds persisted over the decade, and the perception of the risks associated with development adjusted accordingly.

There was the temptation for developers to look at projects with smaller assumed profits, seemingly safe in the expectation that the secular tailwinds that had helped improve returns over the decade would continue to be supportive.

Debt was cheap and enhanced the rate of compression gains. Grid, planning and land were less scarce than they are today; and in many markets, there was a fixed and non-auction driven tariff available to many projects.

How the outlook changed in a higher-rate environment

Last year saw challenges in the development market, with large and respected names reporting challenges.

Orsted suffered a significant share price fall and management changes driven by numerous factors, including announced impairments on its United States offshore wind development platform.

Vattenfall walked away from the 1.4 gigawatt Norfolk Boreas offshore wind farm in the United Kingdom with a £400 million (S$682.3 million) impairment charge.

The 2023 round of UK offshore wind auctions resulted in no bids being made, as the increase in cost of capital and capex was not reflected in the strike price.

Projects that commenced construction over the last two years and utilised leverage are likely to be affected by the rise in cost of capital.

This will mean that development premiums and ultimate returns are under pressure for “build and sell” investors.

Fundamental risks still prevail for development-stage projects: land, grid, planning and route to market are now much harder to secure than in the earlier vintages.

The prize of a fixed price offtake used to be the same for all; now only some developments will be awarded an offtake agreement and only then often as part of a competitive process.

This does not mean the renewables industry or its participants are broken, or the energy transition has been derailed. Ultimately, the world still requires wind and solar to achieve its net-zero goals, and developers will be crucial to delivering that.

Solar may currently be an easier option for many developers, but the higher load factors and more consistent generation profile of wind will be crucial for future electricity supply. This is especially the case if we consider the production of green hydrogen alongside wind power.

Moreover, while the levelised cost of electricity (LCOE) for renewables has increased, it remains an attractive part of the energy mix due to its cost effectiveness, scale and security of supply.

Appraising relative risk in today’s environment

The combination of inflationary costs, rising interest rates and structural shortages in supply chains all combine to present a more challenging environment for developers.

After a decade of low inflation, low interest rates and falling capex/LCOE for renewables, there has been a sharp reversal. Developers and policymakers need to adjust to the new world.

Future projects will need higher prices and regulatory frameworks that de-risk delivery. In this adjustment phase, which will play out over years and not months, there is a danger that some developers misprice risks, leading to issues such as those we witnessed in 2023.

Investors must price these risks into the returns they require and assess returns on a relative basis against simpler operational assets.

So, what happens in the future? Many market commentators believe that we have hit peak interest rates in the current cycle, and this would support lowering discount rates over time which could assist the “build and sell” investor.

Conversely, the amount of projects coming to market and the general lack of capital could mean that discount rates continue to rise, at least over the short to medium term.

While the uncertainty about the direction of discount rates from here will have “buy and hold” investors pondering their entry point into the asset class (largely exposing them to regret risk), this uncertainty could be either a headwind or a tailwind for current vintages of ”build and sell” investments – with the potential to lead to either the delivery of strong returns or potentially losses.

The writer works in the private markets group at Schroders

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

ESG

South-east Asia ESG bonds issuance up 27.4% in Q1 2024 to US$5.1 billion

HSBC asked by US$890 billion investor group to set energy goal

Barclays is the latest firm to face anti-ESG wrath in Oklahoma

EU, ISSB agree on minimising overlaps in company climate disclosures

Emerging markets have greatest transition needs, offer most investment opportunity

Family businesses must lead the way in sustainability: TPC’s Chavalit Frederick Tsao