Singapore’s growth should strengthen to ‘around potential rate’, output gap to close by end-2024: MAS

This comes as global economic growth is expected to remain resilient this year

SINGAPORE’S growth should strengthen to “around its potential rate” for 2024 as a whole, the Monetary Authority of Singapore (MAS) said on Friday (Apr 26), in a slight upgrade of its earlier expectations.

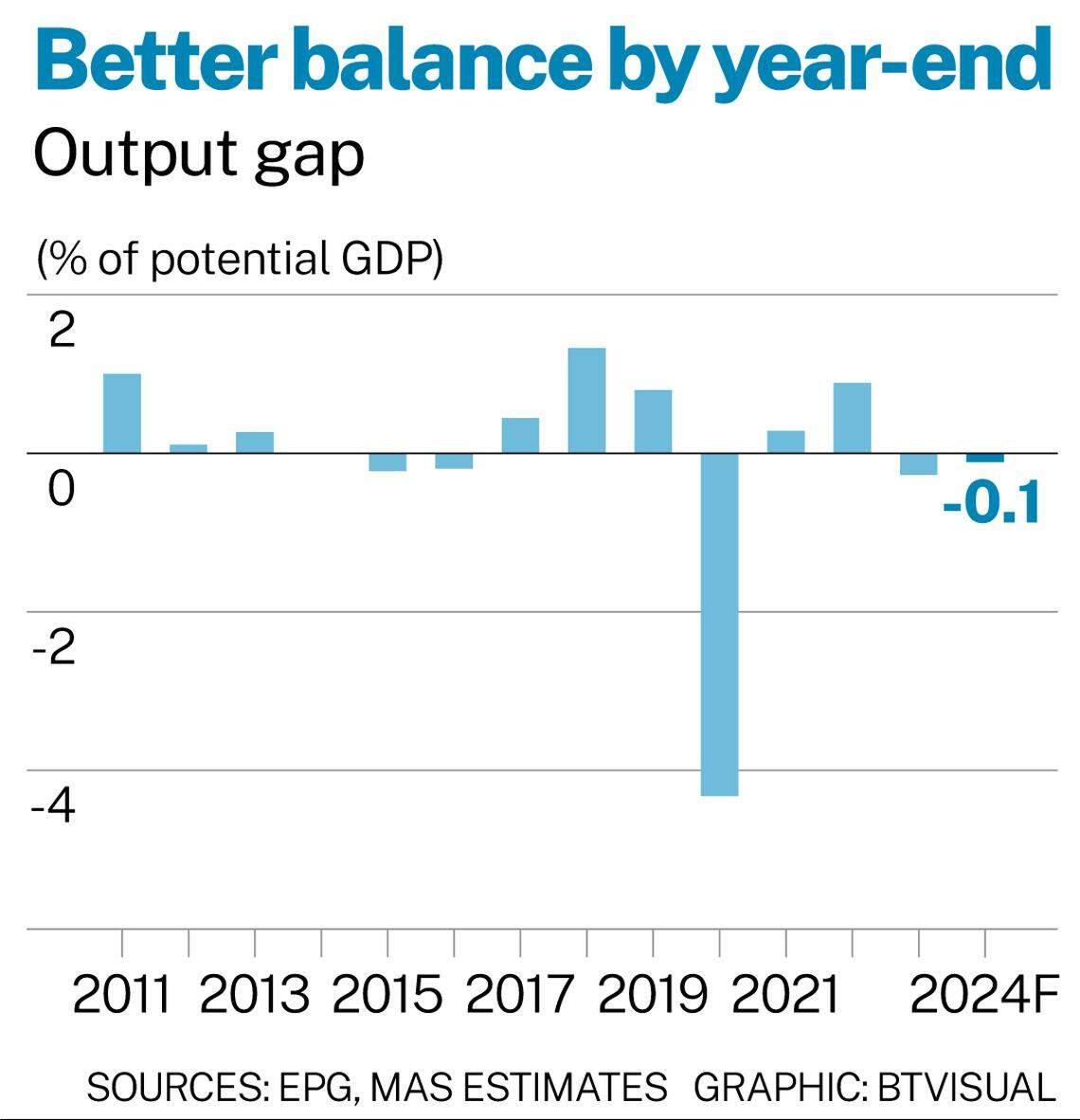

The negative output gap – where the economy’s output is less than what it can produce – is therefore expected to narrow and close by year-end, the central bank added in its half-yearly macroeconomic review.

This is in contrast to the previous macroeconomic review in October, where the expectation for 2024 was that Singapore’s growth would “come in closer to its potential rate” with the output gap remaining slightly negative.

Singapore’s potential growth – the rate of growth it can sustain in the medium term without excess inflation – has not been stated explicitly by MAS, but is generally seen as being 2 to 3 per cent. A negative output gap means that there has been spare capacity in the economy due to weak demand.

More recently, MAS said in its January and April 2024 monetary policy statements (MPSes) that the slightly negative output gap in 2023 will continue to narrow in the second half of this year.

Global resilience

In the latest report, MAS’ more confident outlook comes against the backdrop of a resilient global economy.

SEE ALSO

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Global growth last year, at 3.3 per cent, “showed considerable strength in the face of multi-decade higher interest rates”, MAS said.

Recent high-frequency data suggests continued resilience in 2024, with a projected 3 per cent growth rate. This should improve to 3.3 per cent in 2025, as central banks “cautiously begin to normalise monetary policy”.

But MAS also warned that the impact of past policy tightening and less supportive fiscal policy in most economies will continue to restrain growth.

The United States is expected to register “fairly robust growth”, as pandemic-era savings and net wealth growth “have created a virtuous cycle of strong household spending, improved corporate profitability and solid labour market conditions”.

In contrast, “relatively sluggish” momentum is expected in the eurozone and Japan in the short term, with improvements in H2 2024.

In China, renewed momentum in H2 2023 has carried over to 2024. But gross domestic product (GDP) growth is forecast to ease in 2024, “even as the larger projected fiscal deficit this year imparts a positive impulse to the economy”.

Globally, the pace of disinflation is likely to be uneven amid higher energy prices, persistent service inflation, and some uptick in goods inflation.

Getting back to normal in Singapore

For Singapore, full-year GDP growth for 2024 is still expected at between 1 and 3 per cent, “with the main clusters of the economy converging towards their pre-pandemic growth rates”.

In the first quarter, the economy faced two opposing forces: a pullback in manufacturing after an earlier electronics-led surge, versus a concert-led boost to tourism-related industries. In the coming quarters, both these factors are likely to dissipate, said MAS.

Electronic production should be supported by a continued upturn in the global tech cycle, while tourism-related activity should normalise after the windfall from Q1’s large-scale concerts.

The global semiconductor industry is on the cusp of an expansion phase, noted MAS. The cyclical upturn in tech should support the overall recovery in global goods trade this year, in turn driving improvement in Singapore’s trade-related industry clusters.

Maybank economist Brian Lee expects the city-state’s manufacturing and exports to pick up in the next quarters, as the electronics upturn broadens beyond artificial intelligence (AI) servers.

“Singapore’s semiconductor ecosystem is mainly built around mature nodes,” he explained. “We think demand should be supported by new replacement cycles of consumers and businesses for smartphones and PCs; as well as growing demand for generative AI applications in consumer electronics.”

The financial sector’s recovery should also continue as global interest rates ease gradually.

Growth in the travel-related and domestic-oriented clusters, meanwhile, will continue to moderate but stay above trend.

“For the rest of the year, the Singapore economy will likely be driven by a broad alignment of the global macroeconomic, tech and interest rate cycles,” the monetary authority said.

The labour market, too, is expected to see a return to pre-pandemic conditions. After strong post-Covid employment growth in the past two years, labour demand will moderate this year – but supply constraints will keep the labour market close to full employment.

Overall, hiring is expected to ”stay relatively modest” for most of 2024, due to soft or uncertain demand. But in the second half, the anticipated pick-up in GDP growth should boost labour demand modestly.

Wage growth, too, is expected to “continue to slow towards pre-Covid norms”.

Holding the pause

The review reinforced economists’ expectations that MAS will maintain its monetary policy settings.

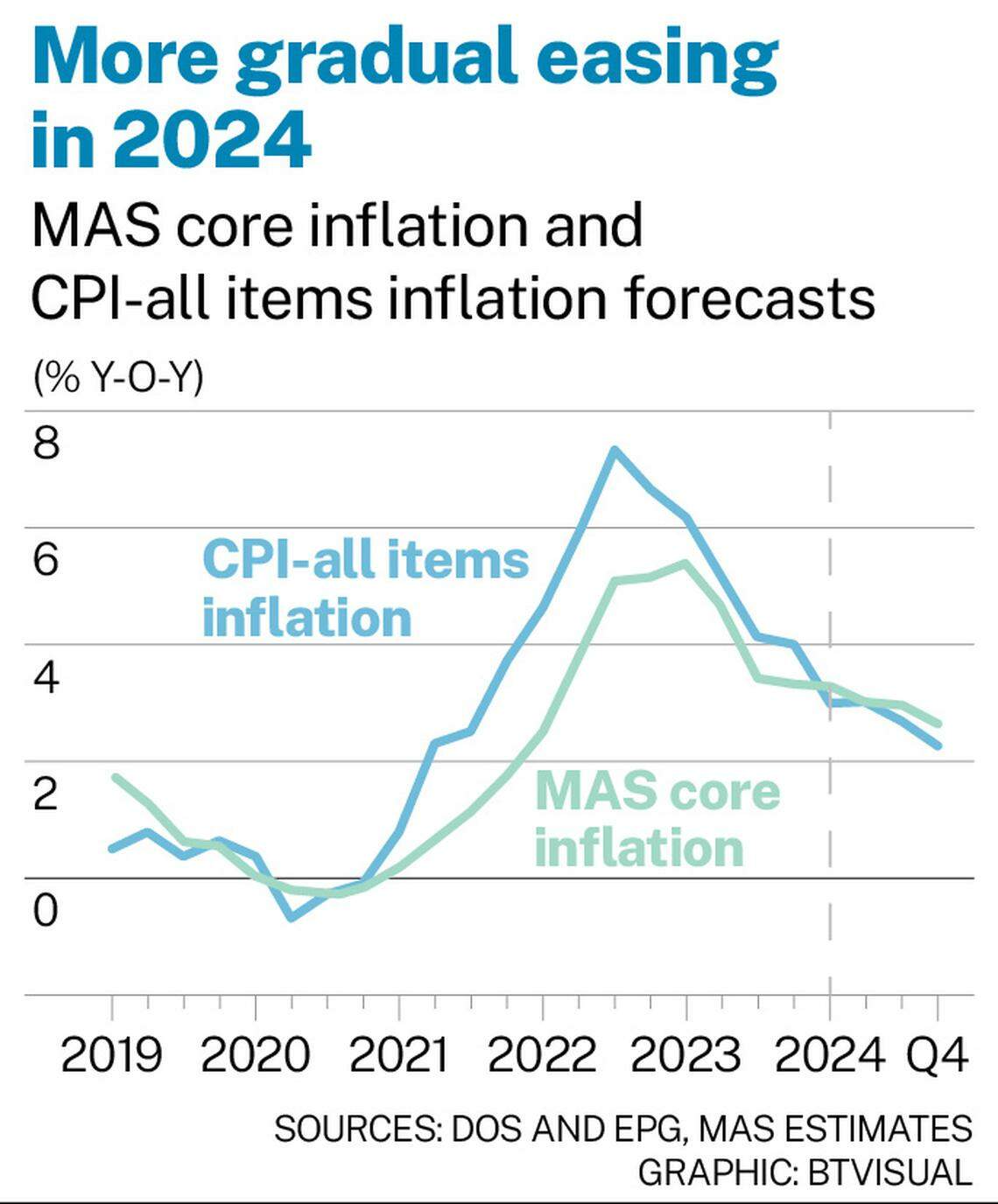

The central bank has not changed its full-year expectations for headline and core inflation to both fall between 2.5 and 3.5 per cent. Core inflation is expected to “hover slightly above or close to 3 per cent” in the next two quarters, before falling more discernibly in Q4 and 2025.

Maybank also expects this stickiness, and projects that it will “drift down gradually” towards 2.5 per cent by Q4.

“The slower pace of decline in inflation this year partly reflects the smaller dampening effect of falling imported inflation compared to 2023,” MAS said. “Meanwhile, consumer prices are likely to continue catching up with higher cost levels in some goods and services sectors for a while.”

Barclays economist Brian Tan said: “Compared with the October 2023 macroeconomic review, the MAS’ latest core CPI (consumer price index) projections appear to be higher – further justifying continued caution on inflation.”

The review’s tone “seems more clearly hawkish” than April’s policy statement, and it appears to place more weight on the upside risks to inflation, compared with the MPS’ more balanced wording, he added.

Tan anticipates no policy adjustments through 2025, with risks tilted more towards further tightening than easing.

Similarly flagging MAS’ “cautious inflation outlook”, OCBC chief economist Selena Ling said that the central bank will likely stay cautious about recalibrating monetary policy settings.

“Hence, the bar to a S$NEER (Singapore dollar nominal effective exchange rate) easing is high for the upcoming July or even October MPS.”

Frederic Neumann, chief Asia economist and co-head of global research Asia at HSBC, said that any unforeseen overshoot in activity could pose a risk to price stability, and MAS will be mindful of this, given the closing output gap.

It will thus need to carefully balance “nudging the recovery along and not allowing price pressures to bubble up again”.

“For now, this suggests that the MAS can afford to stand pat, monitoring developments for a while before deciding its next move.”

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Singapore

Two men convicted in S$3 billion money laundering case deported to Cambodia

Beyond giving grants, EnterpriseSG seeks to be more proactive about helping businesses transform

100 years on, SICCI to focus on internationalisation, digitalisation and sustainability

Taylor Swift effect: Singapore hotels’ average room rate grows in March; tourist arrivals reach new post-Covid high

Singapore top recipient of Q1 cross-border investments in Apac: Knight Frank

Shanmugam, Vivian seek aggravated damages from Lee Hsien Yang over post on Ridout Road rentals