Healthy people are the foundation for healthy economies. The United Nations Sustainable Development Goal 3, to ensure healthy lives and promote well-being for all at all ages, is not just a social responsibility, but also an economically germane pursuit.

From an investor's standpoint, the health theme runs the gamut of opportunities - from health preservation and disease prevention to care service delivery and treatment. Indeed, an entire industry has materialised over the past decade around prevention, with wrist pedometers and other smart personal health monitoring devices now omnipresent and insurance companies offering subscribers financial incentives to adopt healthy lifestyles.

Innovation is also shrinking the drug development timeline. As the world was awestruck in 2020, several companies developed and commercialised highly effective Covid-19 vaccines over the course of months - a process that normally takes many years - and some using the novel mRNA technology.

Accessing the value created by medical innovation in biotech

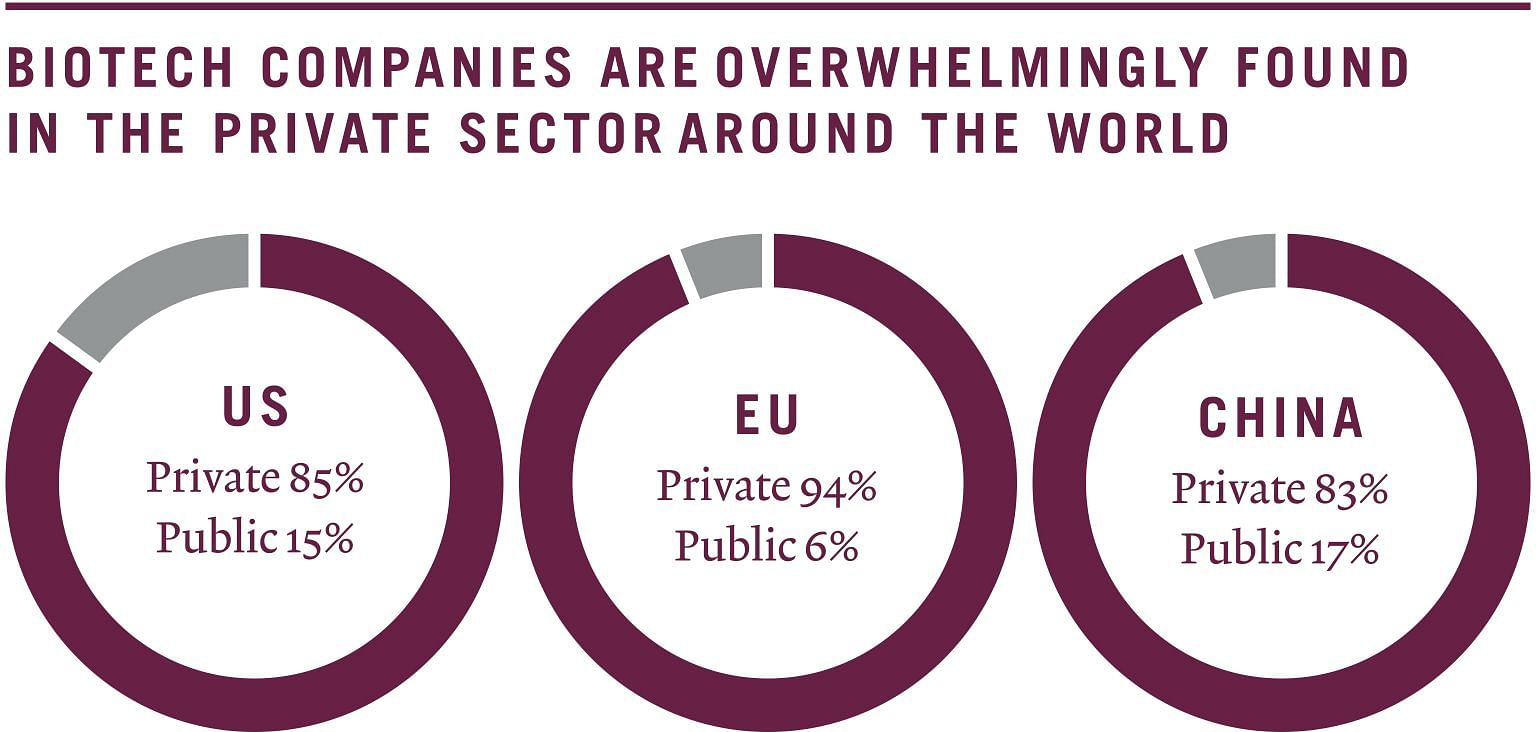

Indeed, the biotech sector has revolutionised the treatment of disease over the past four decades. However, there remain more than 7,000 rare diseases without a cure available today, despite the high volume (470) of drug approvals for such diseases. Biotech companies are on the front line in developing effective treatments for a host of complex diseases. Encouragingly, the pipeline of biotech companies' innovative drugs to tackle major unmet medical needs is rich. Because these drugs require funding to achieve maturity, private markets are the driving force behind this kind of healthcare innovation.

The drugs market is driven by innovation and, despite strong barriers to entry, once a product to treat a disease with no other cure is approved for distribution, market penetration is less of a challenge. This means that most of the value creation takes place during the product development stage, in which most biotech companies are privately owned.

At the same time, there has been a high volume of mergers and acquisitions (M&A) activity in the sector. Indeed, according to CB Insights, the third quarter of 2021 marked the highest level on record, with more than 800 biotech M&A deals and over US$36 billion (S$50 billion) in funding flows. This growth in the biotech sector has been resilient and stable for more than a decade.

Sources: US (www.usalifesciences.com), EU (www.euronext.com), China (www.mckinsey.com)

Addressing health threats with digital technology

At the same time, the threats to our health are mounting on all fronts. Lifestyle and demographic trends drive higher incidences of threats from within our bodies, while globalisation and the degradation of our environment produce threats from without. Healthcare systems around the world are under severe strain, while care worker shortages are exacerbated by exhausted professionals opting to change careers.

The intersection of digitalisation and healthcare in an increasingly hyperconnected world has given way to the field of digital health, which includes industries like mobile health, health information technology, wearable devices, technology-enabled drug discovery, telemedicine and many other applications.

This presents a compelling prospect to investors, as novel and exciting technologies emerge that create real world solutions. One such nascent and exciting area of opportunity is digital therapeutics, which are software-based devices used to treat disease.

The digital health sector is supported by strong underlying industry trends. With ageing populations and chronic lifestyle diseases on the rise around the world, healthcare costs have grown, leaving the sector ripe for disruption. At the same time, increased focus on health and wellness has driven up patients' demand for better and customised care. Like in other sectors, digital technologies in healthcare have the potential to disrupt the entire value chain, from drug discovery to the management of care delivery, including patient self-care.

As across nearly all sectors, technology will provide many of the requisite solutions within healthcare - from modular-enabled clean rooms required for research and development to international supply chain optimisation and remote care and monitoring. And, often, the originators of these highly innovative solutions are small, privately owned start-up companies. As a result, much of these companies' value is created before they are accessible via public markets. Investors without liquidity constraints can benefit from diversification effects and potentially higher returns by adding a private-assets allocation to their portfolios.

Find out more with Pictet.

Disclaimer:

This advertisement has been approved for issue by Bank Pictet & Cie (Asia) Ltd ("BPCAL") in Singapore which is a wholesale bank regulated by the Monetary Authority of Singapore under the Banking Act Cap. 50 of Singapore, an exempt financial adviser under the Financial Advisers Act Cap. 110 of Singapore and an exempt capital markets license holder under the Securities and Futures Act, Cap. 289 of Singapore.

The value of an investment can go down as well as up, and investors may not get back the full amount invested. Nothing in this document shall constitute financial, investment or legal advice. The information presented in this document are provided for reference only and are not to be used or considered as an offer, a recommendation, an invitation to offer or solicitation to buy, sell or subscribe for any financial instruments. This document is intended for general circulation and it is not directed at any particular person. This document does not have regard to the specific investment objectives, financial situation and/or the particular needs of any recipient of this document.

All rights reserved. Copyright 2022