Broker's take: Singapore property developers trading at discount, RHB keeps 'overweight'

SHARES of Singapore-listed real estate developers are trading at deep discounts to their book values and revalued net asset values (RNAV), thus offering "good value" at current levels.

That's according to RHB analyst Vijay Natarajan, who kept his "overweight" rating on the sector in an update on Monday and picked CapitaLand as the top "buy" idea.

Since the economy reopened, the Singapore property market has surprised with a strong rebound in transaction volumes and stable prices.

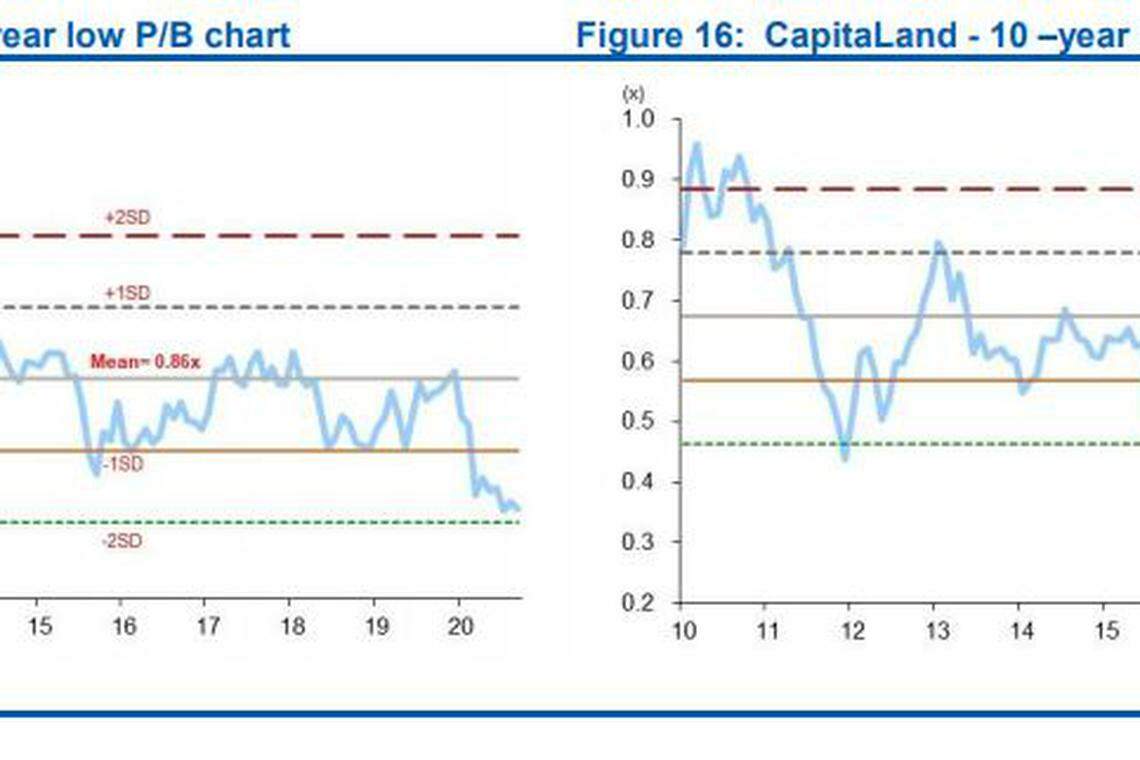

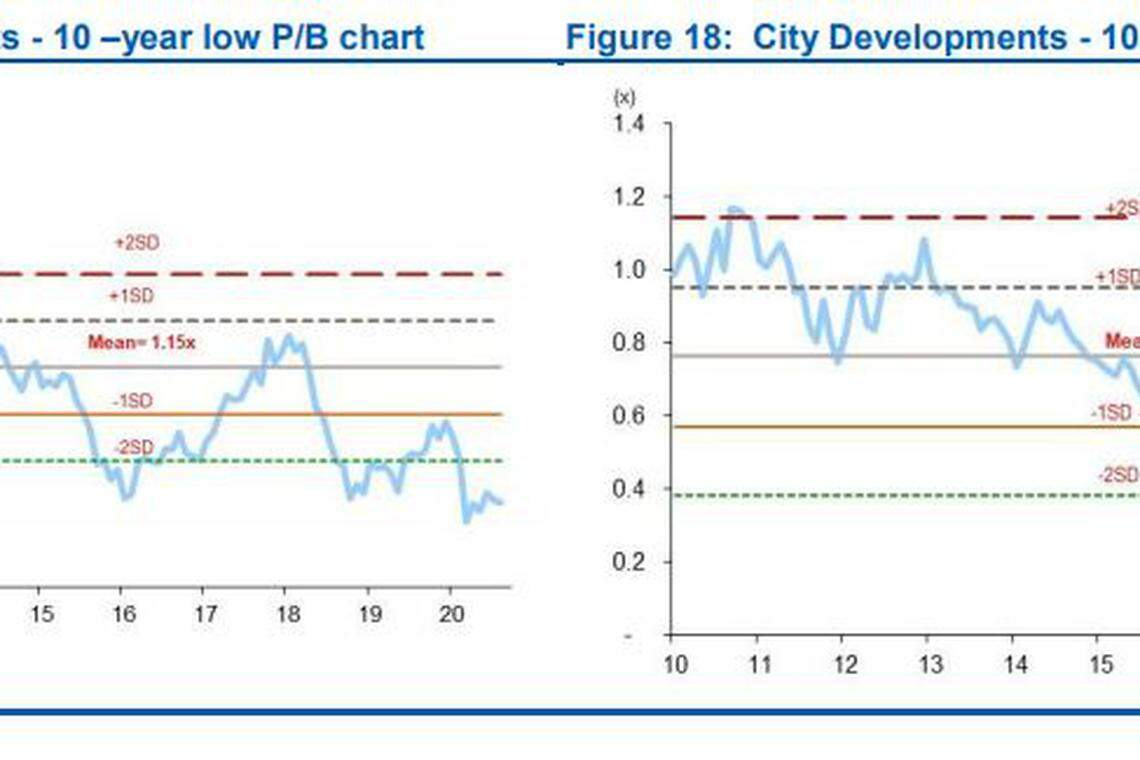

In contrast, the real estate sector index is down 28 per cent in the year to date. Large-cap stocks under RHB's coverage are trading at a 40-60 per cent discount to RNAV, which is a decade low and closer to minus-two standard deviation levels, Mr Natarajan wrote.

"We don't expect any significant asset value write-downs, and only expect a modest 2-5 per cent decline in book values as cap rates have largely remained unchanged," he added.

The research team's top pick is still CapitaLand, with a target price of S$3.75, given the property giant's globally diversified portfolio, stable real estate investment trusts and a growing recurring income base from its fund management platform.

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

CapitaLand shares were trading at S$2.73 as at 11.14am on Monday, down S$0.02 or 0.7 per cent.

RHB also sees City Developments Limited (CDL) as a proxy play on a recovery in the Singapore market, given that it has the largest land bank in the country, as well as its attractive valuations.

These outweigh concerns on CDL's hospitality portfolio, the analyst wrote. He has a "buy" rating and S$9.50 target price on the stock.

CDL shares lost S$0.03 or 0.4 per cent to trade at S$7.68 as at 11.15am on Monday.

Since Singapore's economy reopened in phases starting June after the "circuit breaker", buying demand in the private housing market has roared back rapidly to pre-Covid levels, Mr Natarajan said.

In August, Singapore developers sold 16 per cent more private homes than in July, and 12 per cent more from a year ago. In the year to date, sales volumes are now just about 5 per cent below last year's sales, he noted.

Key drivers of this rebound, in RHB's view, included the ultra-low interest rates and a surge in demand from HDB upgraders with some 50,000 HDB flats expected to cross their minimum occupation periods in 2020 and 2021. Also boosting demand were "attractive" new project launches as well as aggressive marketing.

Furthermore, there has been a noticeable shift in buying demand, from mainly shoebox units - small, private homes spanning 506 square feet and below - to all unit types now. RHB believes this was due to buyers' changing preferences for bigger units after the Covid-19 restrictions.

Overall, the research team has increased its sales volume assumptions to 8,500-9,500 units this year, representing a year-on-year decline of 5-15 per cent, compared to its previous estimates of a 30-40 per cent decline.

That being said, the Urban Redevelopment Authority's (URA) recent clampdown on the re-issuance of options to purchase (OTPs) may cool off some frenzy, Mr Natarajan said.

URA last week curbed private housing developers from re-issuing OTPs to the same buyers of the same unit, amid worries that "financial discipline" was slackening despite the recession.

URA's move came as an increasing number of developers were re-issuing OTPs to buyers upon expiry, without the typical forfeiture of booking fees. Some of these re-issuances were driven by buyers' needing more time to sell their existing units. However, other buyers were using the option as a hedge against future price increases, which RHB believes had caused an increase in speculative purchases.

Thus, RHB foresees a slight cooling effect from the URA's OTP restrictions, with demand likely falling 3-5 per cent in the coming months.

As for private home prices in Singapore, they have stayed largely stable despite the coronavirus pandemic's impact on the economy. Economists told The Business Times last week that the disconnect could be due to low interest rates and the optimism felt by those whose livelihoods remain untouched by the pandemic.

The latest flash estimates also showed a 0.8 per cent quarter-on-quarter increase in Q3 this year for the overall price index for private homes in Singapore, mainly driven by the landed property segment.

Therefore, Mr Natarajan now foresees private residential property prices dipping by just zero to 3 per cent for this year, compared to his previous assumptions of a 5-10 per cent decline.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

S&P slashes Boeing credit outlook as rating hovers above junk status

Honda to spend US$11 billion on EV strategy in Canada

GlaxoSmithKline sues Pfizer and BioNTech over Covid-19 vaccine technology

Mapletree Industrial Trust Q4 DPU rises 0.9% to S$0.0336

Nasdaq’s profit falls as shaky economy keeps IPO revival elusive

iFast Q1 net profit surges on ePension unit performance