BT Explains: What happens when a Spac makes a business combination?

VERTEX Technology Acquisition Corporation (VTAC) said on Monday (Oct 2) that it has entered into a conditional sale and purchase agreement for a proposed business combination with livestreaming platform 17Live.

It is the first time a Singapore Exchange (SGX) special purpose acquisition company (Spac) has announced a potential business combination – also known as a de-Spac transaction.

Here’s a recap on Spacs, business combinations, and other things to consider as an investor.

What are Spacs?

Spacs are vehicles designed to acquire another company. They are an alternative to initial public offerings (IPO) for companies to go public. Such instruments were highly popular in US markets in 2020 and 2021, but the boom fizzled out in 2022 amid more challenging macroeconomic conditions.

Spacs are set up by a group of investors, known as sponsors. These are usually professional fund managers, or former senior executives of large companies, with mergers and acquisitions expertise.

SGX unveiled rules in 2021 to allow for Spacs in the Singapore market, and three have listed so far: VTAC : VT1 0%, Pegasus Asia : PGS 0%, and Novo Tellus Alpha Acquisition : NTA 0%.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

At listing, Spacs are shells with no operating business. This is different from traditional IPOs, which have one or more areas of business operations that generate revenue, and in most cases, profits.

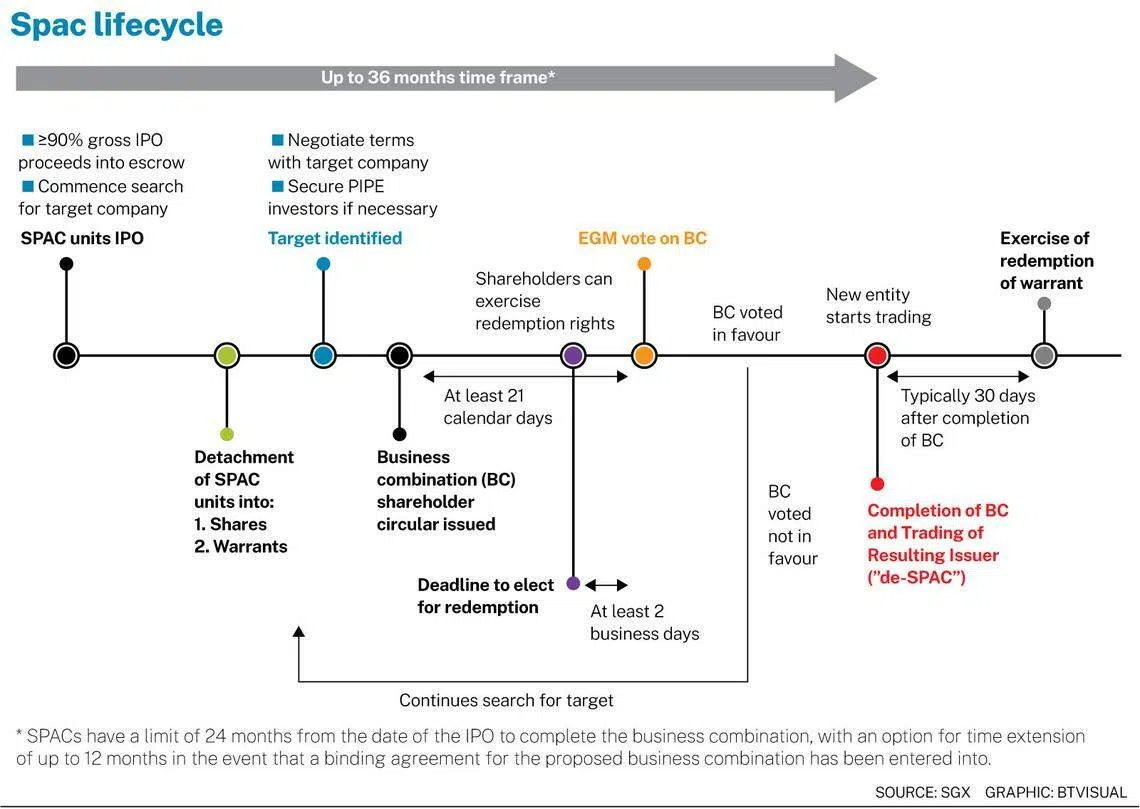

Investors get units of a Spac at IPO, comprising a share and a part of a warrant. The included warrant can provide additional upside to investors should the eventual target company outperform.

Spac units will separate into individually traded Spac shares and warrants on the detachment date, which is typically 45 calendar days after the Spac’s listing.

Most of the proceeds raised during the IPO are placed in escrow pending the acquisition of a target. The goal of Spac sponsors is to find a suitable target company to combine within a set timeline.

Business combination

Local Spacs have two years to complete a suitable acquisition, with the option for a one-year extension, subject to certain conditions. The three Singapore Spacs all listed in January 2022, putting them close to their two-year business combination deadlines.

If a suitable target is found, and a simple majority of shareholders and independent directors vote in support of the transaction, then the Spac merges with the target.

Known as a business combination, this results in the target being listed on the exchange.

This is similar to reverse takeovers, but Spacs do not come with the burden of having debt or other obligations that need to be disposed of.

Over the longer term, the hope would be for the acquired company to grow and deliver long-term shareholder value, under the continued guidance from the sponsors. Some have called Spacs the “poor man’s private equity” as it allows investors access to deals that are normally within the realm of private markets.

Investors have the chance to vote on business combinations that are brought to them by sponsors. If they are not keen on the proposed target, or its valuation, investors can redeem their pro-rata share of the escrow account, regardless of how they voted.

If no suitable target is found, or if the majority of shareholders vote against the business combination, the Spac will be liquidated and the pro-rata share of the escrow account will be returned to shareholders.

Sponsors are usually compensated for their work done in the Spac with shares obtained for a nominal sum, known as the “promote”. In Singapore, this is capped at 20 per cent of the total issued shares at listing.

After the business combination, investors would be shareholders in the target company. This would be similar to what investors are used to in regular IPOs, where their investments are in an operating company.

Things to consider

Spac shareholders facing a business combination would need to decide on whether to vote in favour of the acquisition, and whether they want to exercise their redemption rights to recover their pro-rata share of the escrow account.

Similar to traditional IPOs, the valuation of the target company is a key consideration.

Spac investors would also need to consider the impact of any dilutive provisions that may be present in the structure. This may come from warrants, or the sponsor’s promote. In Singapore, there are regulatory provisions to cap the dilution from warrants as well as sponsor promote.

The Securities Investors Association (Singapore) previously said in 2021 that it will independently appoint a research firm to provide independent research on de-Spac transactions.

Such reports could help investors understand the business fundamentals behind each deal.

The level at which a stock trades immediately after a de-Spac transaction is announced may also give an indication of how the market is perceiving the deal, but trading valuations should be treated with some caution.

A Spac’s share price would likely be stable prior to the completion of a business combination, as the redemption rights provide downside protection.

But it is more important for investors to consider whether a counter can sustain that share price performance in the long run.

VTAC shares last traded at S$4.81 before a trading halt was called on Monday. Meanwhile, Novo Tellus Alpha Acqusition closed unchanged at S$4.60, while Pegasus Asia rose 3.3 per cent to S$4.70 on Monday.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Vietnam forfeits billions of US dollars in foreign aid amid anti-graft freeze

Asia: Stocks mixed after Wall Street, Europe retreat from records

Mapletree closes second Japan logistics development fund, expects 110 billion yen AUM

Dolce & Gabbana metaverse fashion offering leaves shopper fuming

Microsoft offers cloud customers AMD alternative to Nvidia AI processors

CEO of fallen Eagle Hospitality Trust seeks to contest four disclosure-related criminal charges