Fewer Singaporeans able to spend beyond basics and more are short on emergency funds: OCBC survey

Bank’s financial wellness poll also finds Singaporeans managing debt better amid continued high interest rates, inflation

FEWER Singaporeans are able to comfortably spend on things beyond the basics, and more do not have sufficient emergency funds or enough savings to meet their families’ needs over the next year, a survey by OCBC found.

According to the bank’s annual Financial Wellness Index released on Wednesday (Nov 8), just 40 per cent of Singaporeans can afford to spend beyond the basics most of the time, down eight percentage points from 2022.

Nearly a quarter of respondents, or 23 per cent, said they can only afford the basics, while another 36 per cent said they have to save up for things beyond the basics.

This comes as 2023’s Financial Wellness Index score fell to 60 points – the lowest since the inception of the index in 2019.

“2023 has been yet another tough year, with the continuation of high interest rates, inflation and turmoil in the financial markets,” said OCBC’s head of group wealth management Tan Siew Lee.

The annual survey by OCBC is a review of Singaporeans’ financial wellness. In this year’s survey of 2,000 working adults, Singaporeans fared worse across most indicators.

A NEWSLETTER FOR YOU

Thrive

Money, career and life hacks to help young adults stay ahead of the curve.

Focus on debt management

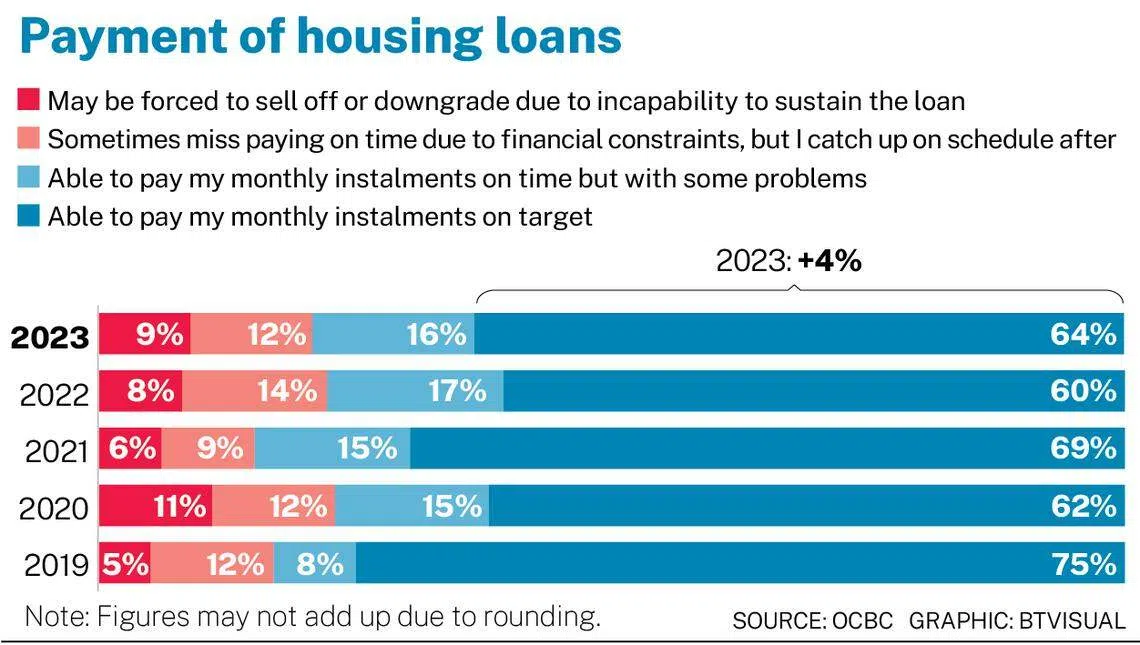

One trend is that Singaporeans are prioritising debt repayments amid higher interest rates, with more being able to pay off their home loans and other personal debts on time.

For example, some 64 per cent of Singaporeans said they are able to pay monthly instalments on their housing loans on time, up four percentage points on year.

However, 9 per cent of respondents said they may be forced to sell or downgrade their properties as they are unable to sustain the loan. This is up one percentage point from 8 per cent a year earlier.

Fewer Singaporeans also have unsecured debt, such as credit card or education loans. The percentage of respondents with unsecured debt fell three percentage points to 28 per cent.

Said Chin Mun Hong, head of market insights at OCBC: “Singaporeans have focused on debt management. I think this is not surprising, because of higher interest rates and higher mortgage payments (required).”

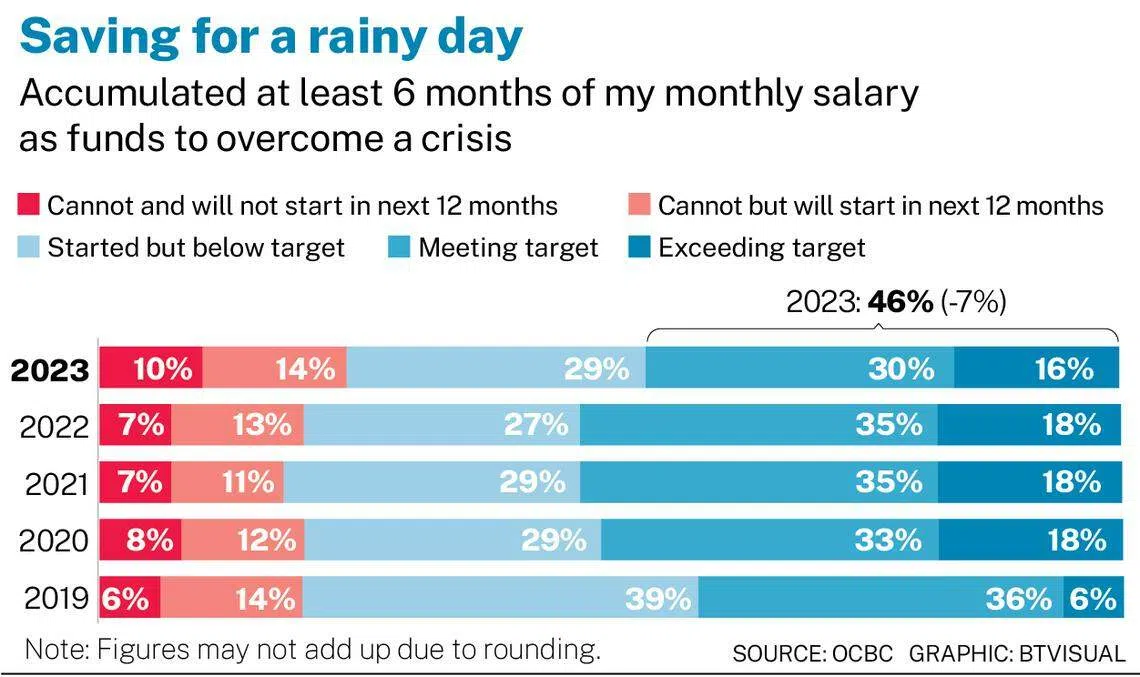

Yet, the report found that Singaporeans are saving less and are not as prepared for a rainy day.

Some 84 per cent of survey respondents save at least 10 per cent of their salary, down from 91 per cent in 2022.

Some 53 per cent also think they do not have at least six months’ salary as funds to overcome a crisis, up from 46 per cent the year before.

Chin said: “As there’s some focus on debt management, some of these immediate goals have taken a slight shift.”

Of the index’s 24 indicators, “planning for retirement” had the sharpest decline, falling to 40 points in 2023 from 47 in 2022.

Some 79 per cent of Singaporeans either do not have a retirement plan or are not on track with their retirement plans, rising from 71 per cent in 2022.

The age at which people intend to start planning for retirement has also been pushed back, even among older Singaporeans.

Of those who have not started planning for their retirement, those in their 50s said they intend to start at age 60, two years later than what was said in 2022. Those in their 20s said they plan to start at 42, eight years later than what was said in 2022.

Investments take a back seat

Meanwhile, there are also fewer Singaporeans investing.

Some 79 per cent of Singaporeans have investments in 2023, compared with 85 per cent a year earlier.

The average rate of returns for Singaporean investors fell to 0.4 per cent in 2023, from 0.7 per cent the previous year.

Gen Zs and young millennials had the highest proportion of investors who had losses, with 40 per cent of those in their 20s with negative investment returns.

This is likely due to a lack of rigorous research, as one in five seek investment-related advice and news only from social media channels and chat groups. Many may also not realise they have a blind spot.

Of all the age groups, Gen Z and young millennial investors were likely to have been affected most by their international stocks, which have taken a pounding this year.

Tan said: “The silver lining is that Singaporeans are managing their debt better this year and are still saving well. These are virtues that Singaporeans must continue to practise, especially given the challenging outlook.”

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Bank of Singapore takes action against employees for misusing medical benefits

UBS weighs synthetic risk transfer amid capital boost proposals

Oil settles higher on supply concerns in the Mid-East, economic woes subdue gains

S-Reits falter as investors weigh possibility of zero rate cuts in 2024

CapitaLand Investment posts total revenue of S$650 million for Q1

Europe: Stoxx 600 logs best day in three months as banks shine