Governance index leaps to new high, but still room for improvement

It hits record 67.9 points; but scores for accountability and audit, disclosure and transparency slide as some still fail to embrace spirit of the rules

Singapore

THE Singapore Governance and Transparency Index (SGTI) 2020 surged to a record high, but two crucial components - accountability and audit as well as disclosure and transparency - have been falling and warrant concern, as industry players see an even greater need for governance to survive the Covid-19 turmoil.

In his opening address at the Singapore Governance and Transparency Forum, Singapore Exchange Regulation (SGX RegCo) chairman Tan Cheng Han stressed that in times of rapid change and uncertainty, it is crucial to embed the culture of timely, accessible and transparent disclosures within a company.

"During this era of extreme uncertainty and therefore risk, it is obvious that high standards of corporate governance, including proper disclosures to members of the investing public, become even more important," he said.

A "top-down" and "highly prescriptive approach" to corporate governance by regulators will not always be helpful in such circumstances, he added. "Of course this is not binary; there will be times when clear prescriptive rules are necessary and these can co-exist with principles-based rules for corporate governance."

There is still a tendency for some companies to act according to the letter of the law, rather than its spirit, resulting in tardy and vague disclosures. All stakeholders, especially management, need to respect the roles of other stakeholders and "to see them as partners rather than as a necessary cost for doing business", Mr Tan said.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The SGTI, which assesses companies on corporate governance disclosure and practices as well as the timeliness, accessibility and transparency of their financial results announcements, hit a record high of 67.9 points this year against 59.3 points last year, in the general category assessing 577 listed companies.

The 45 real estate investment trusts (Reit) and business trusts, on average, achieved a higher score of 84.8, partly due to additional regulatory requirements. The SGTI is a joint initiative of CPA Australia, NUS Business School's Centre for Governance, Institutions and Organisations (CGIO), and Singapore Institute of Directors. The Business Times is the strategic media partner.

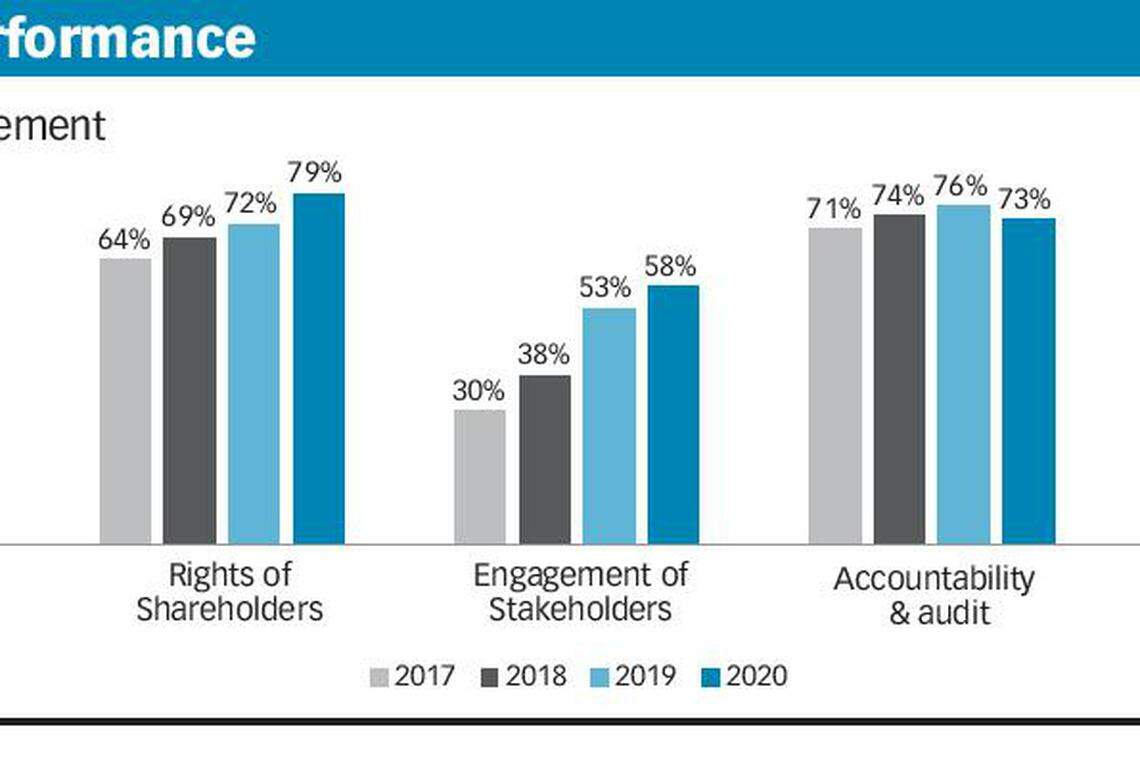

Within the general category, companies showed improvements in scores on shareholders' rights, board responsibilities and stakeholders' engagement. But the percentage score for accountability and audit fell to 73 per cent from 76 per cent previously, while disclosure and transparency dipped to 57 per cent from 58 per cent a year ago.

The percentage score for disclosure of key risks and risk management strategies fell to 24 per cent this year from 33 per cent three years ago and 31 per cent last year. Disclosure of risk tolerance policy fell to 5 per cent from 8 per cent last year. Linking risk management with remuneration also needed to be addressed.

The disclosure of name and relationship for each related party transaction has been falling, from 57 per cent three years ago to 42 per cent this year. Disclosure of the nature and value of each significant related party transaction was also on a decline from 52 per cent three years ago to 38 per cent this year.

In a panel discussion following the unveiling of the findings, Chaly Mah, former chief executive of Deloitte Southeast Asia and chairman of Deloitte Singapore, said many companies have found their business continuity plans do not work in a pandemic environment.

"This is where the board plays a very important role. Because of its governance role, the board has to ask all the difficult questions to management around cost management, conservation of cash... the physical and mental health and safety of your people and whether the business model will survive post-Covid," Mr Mah said.

Beh Siew Kim, chief executive of Ascott Residence Trust's managers, said that during these challenging times for the hospitality sector, environmental, social, and governance (ESG) issues may be slighted, but "the governance part is vital for us to come out of the Covid-19".

Lee Wai Fai, group chief financial officer at UOB, shared that interactions with the board are "very frequent now" and the management is in constant dialogue with investors, including those in the US, on what the bank is doing and where it sees the areas of high risks, especially when the government relief is eventually removed. Frequent communication is also extended to staff, to ease concerns over job security and retrenchments. (see amendment note)

Mr Lee said there is a need to look at disclosure more holistically, rather than in a siloed manner.

Sustainability was another key topic the panel focused on, with many agreeing that it is no longer an agenda driven by regulators, but an embedded practice driven by the market as global funds go green.

UOB's Mr Lee shared that four years ago, the bank was not ready for sustainability reporting, and generated two pages on the topic in its annual report. Today, it makes up 66 pages.

"It's a journey," he said, adding that these days when he makes presentations to investors, he has to allocate up to an hour on sustainability. "We have moved from four years ago, doing what SGX said to do, to now embedding these practices."

READ MORE:

Amendment note: An earlier version misstated that UOB's board is in constant dialogue with investors. This has been amended to reflect Mr Lee's intended meaning, which is that UOB's management is in constant dialogue with investors.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Stocks to watch: CICT, Seatrium, Keppel DC Reit, UOB

Keppel DC Reit reports 13.7% lower Q1 DPU of S$0.02192

Netflix handily beats subscriber targets, misses on revenue forecast

Meta releases early versions of its Llama 3 AI model

Seatrium unit ordered to pay US$108 million in arbitration over equipment supply contracts

TSMC estimates losses of US$92.4 million due to Taiwan earthquake