Hot stocks: Glove makers Top Glove, Riverstone, UG Healthcare see steep drops

FOLLOWING news that Russia is moving to roll out its new Covid-19 vaccine, share prices of the trio of Singapore-listed glove manufacturers all skidded on Wednesday, decimating their gains from recent weeks.

Russia on Tuesday night said it has approved the world's first vaccine against the novel coronavirus, although clinical trials will still continue. The announcement appeared to weigh on sentiment for glove plays, as an effective vaccine is set to curb the spread of Covid-19 and thus dampen demand for gloves.

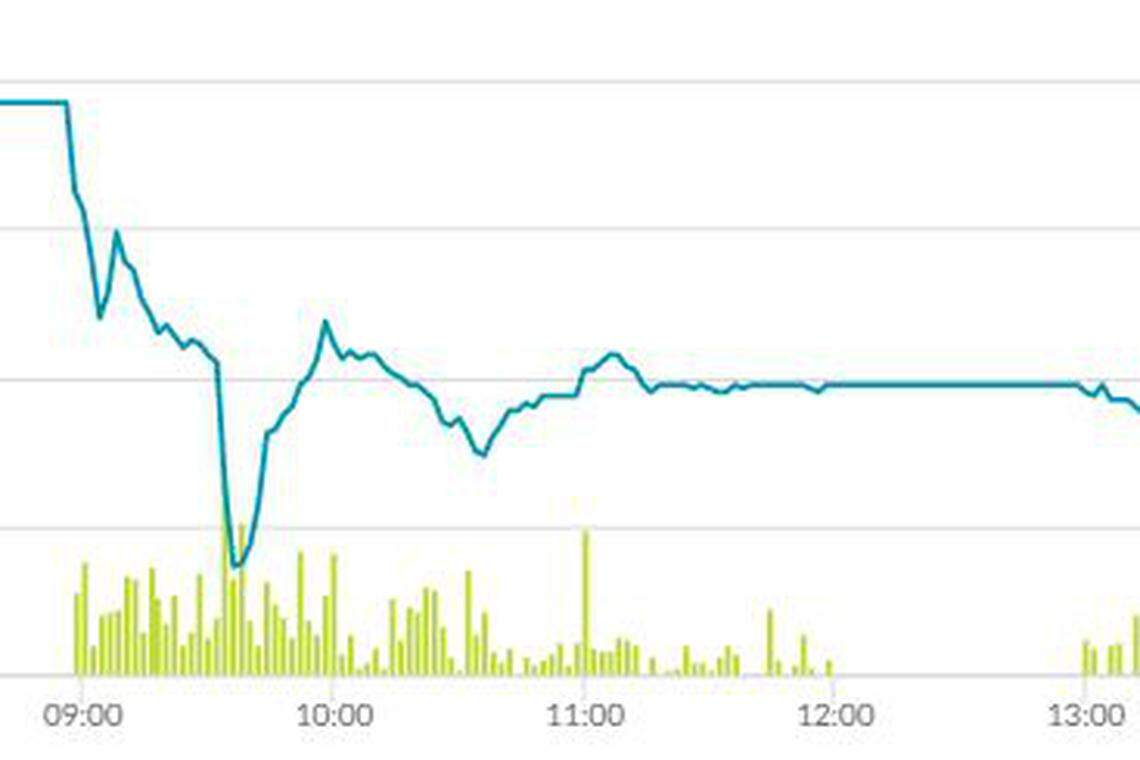

Mainboard-listed Riverstone Holdings sank almost 13 per cent to S$3.98 within the first hour after market open. The counter was trading at S$4.11 as at the midday break on Wednesday, down 10.1 per cent or S$0.46 from Tuesday. About 7.9 million shares changed hands, making it the third most active stock by value on the Singapore Exchange.

Its shares had spiked to a record high of S$4.69 on Aug 7, two days after Riverstone announced that its half-year earnings had more than doubled. The Malaysian company produces natural rubber and nitrile gloves, specialising in clean room and healthcare gloves.

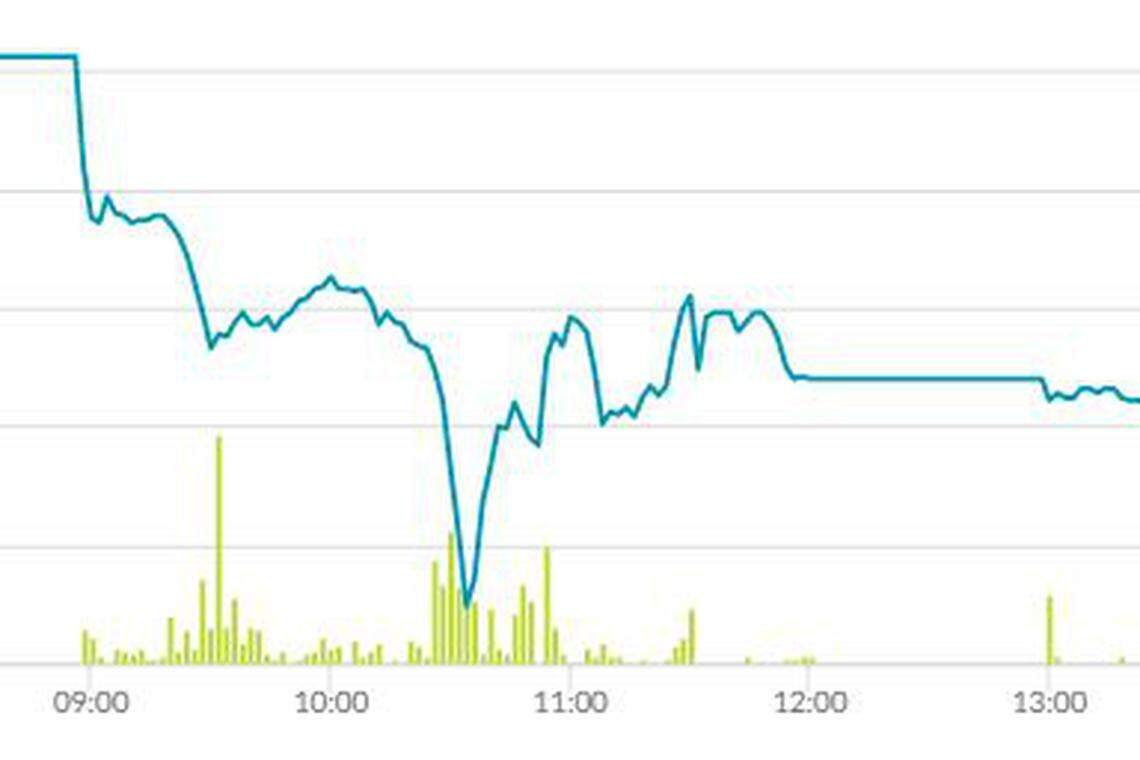

Meanwhile, Malaysia-based Top Glove, the world's largest glove manufacturer, saw its shares on the Singapore bourse plunge 13.3 per cent to S$7.82 at around 10.35am.

It recovered slightly to S$8.35 by the midday break, down 7.5 per cent from Tuesday's close, with 1.6 million shares traded.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The mainboard-listed stock had rallied to a peak on Aug 6 when it closed at S$9.30, up about 38.9 per cent from a month ago.

Top Glove on Monday said it expects to pay about RM53 million (S$17.3 million) in remediation fees to migrant workers it employed before it implemented a new standard for ethical recruitment.

Over on the Catalist board, disposable glove manufacturer UG Healthcare's stellar financial results released a day earlier were not enough to prop up its share performance.

The counter rapidly retreated 18.6 per cent to S$2.74 by 9.36am on Wednesday. It regained some ground to trade at S$2.99 as at the midday break, with 7.1 million shares traded.

Similar to its peers, UG Healthcare had enjoyed a bullish run over the past several weeks, jumping to S$3.37 on Tuesday before it announced its full-year results.

For the second half of its fiscal year ended June 30, 2020, net profit climbed to S$12.6 million - more than 10 times that of S$1.2 million a year ago.

Revenue surged 80.9 per cent on the year to S$91 million from S$50.3 million, boosted by the higher volume and selling prices of gloves, UG Healthcare said in results released on Tuesday evening. The higher revenue came amid the exponential increase in demand for disposable healthcare and medical gloves worldwide due to the novel coronavirus outbreak, particularly in the April-June period.

UG Healthcare's earnings per share stood at 6.4 Singapore cents for the six months ended June 2020, up from 0.61 cent for the year-ago period.

As for the full year, net profit totalled S$13.4 million, about five times that of S$2.5 million in the year prior. Revenue grew 57.2 per cent to S$144.2 million for FY20.

UG Healthcare's board declared a final dividend of 0.714 Singapore cent per share for FY20, up from 0.259 cent per share for FY19, reflecting the group's improved performance.

The drops in share prices of the three glove plays stood in contrast to healthcare counter Medtecs International's performance on Wednesday. The Catalist-listed stock was up almost 19 per cent to S$1.16 by the midday break and clocked the highest volume traded on the Singapore bourse for the morning, after posting a robust set of financial results on Tuesday evening.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

TikTok ultimatum puts US firms in firing line for China response

Toyota and Nissan pair up with Tencent and Baidu for China AI arms race

BHP targets Anglo American in bid valuing miner at US$39 billion

FTSE 100 hits record high on big mining M&A, earnings push

Hermes Q1 sales jump 17% on strong China demand

AstraZeneca leaps after smashing Q1 forecasts