🏠 Picking the best home loans – and what the Fed has to do with it

Find out more and sign up for Thrive at bt.sg/thrive

🤔 How did we get here?

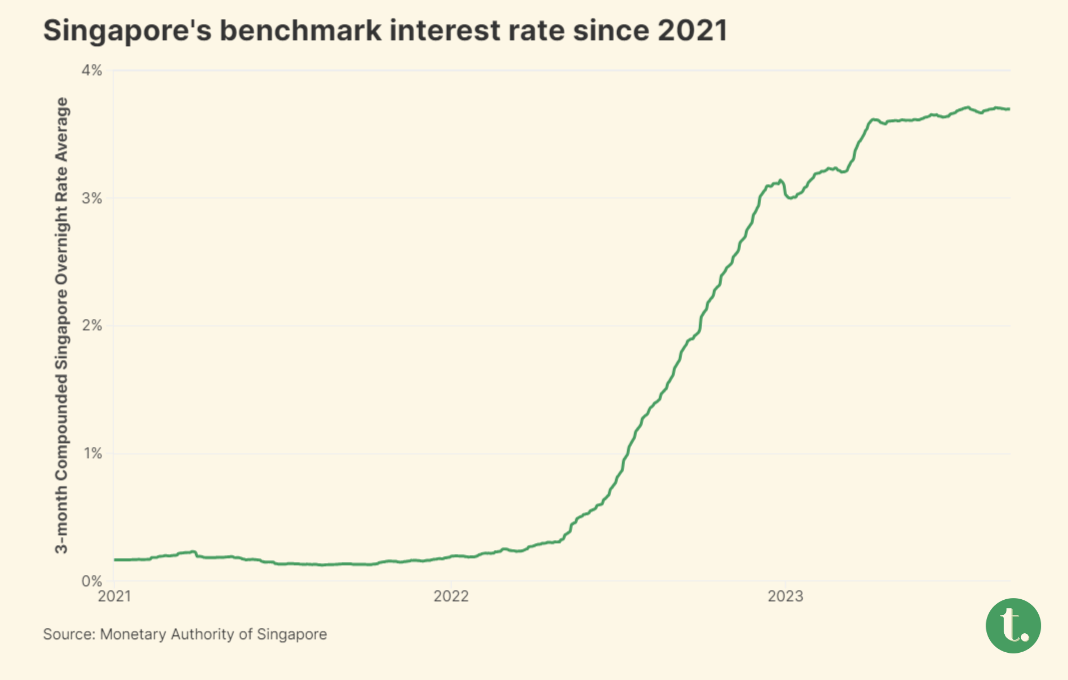

The last time mortgage rates were this high in Singapore, the Electronic Road Pricing toll just began operations and Jack Neo’s first movie Money No Enough was playing in the cinemas. After more than a decade of low interest rates on home loans, the rates have been on a relentless climb – especially over the past two years.

In January, fixed home-loan rates offered by Singapore banks hit a peak of 4.25 per cent per year. They came down to 3.75 per cent in June and are trending lower now. But they are still high by historical standards: For a 30-year loan of S$500,000, a 3.75 per cent interest rate works out to a total of S$334,000 in interest, assuming the rate stays the same.

Why are interest rates so high? The short answer: Inflation. To combat rising costs, central banks raise interest rates so that borrowing becomes more expensive in hopes of cooling down the economy.

Singapore’s case is a bit special because our central bank – the Monetary Authority of Singapore (MAS) – doesn’t control interest rates. So the rates on home loans here largely track interest rate movements in the US, whose central bank – the Federal Reserve – has raised interest rates 11 times since March 2022.

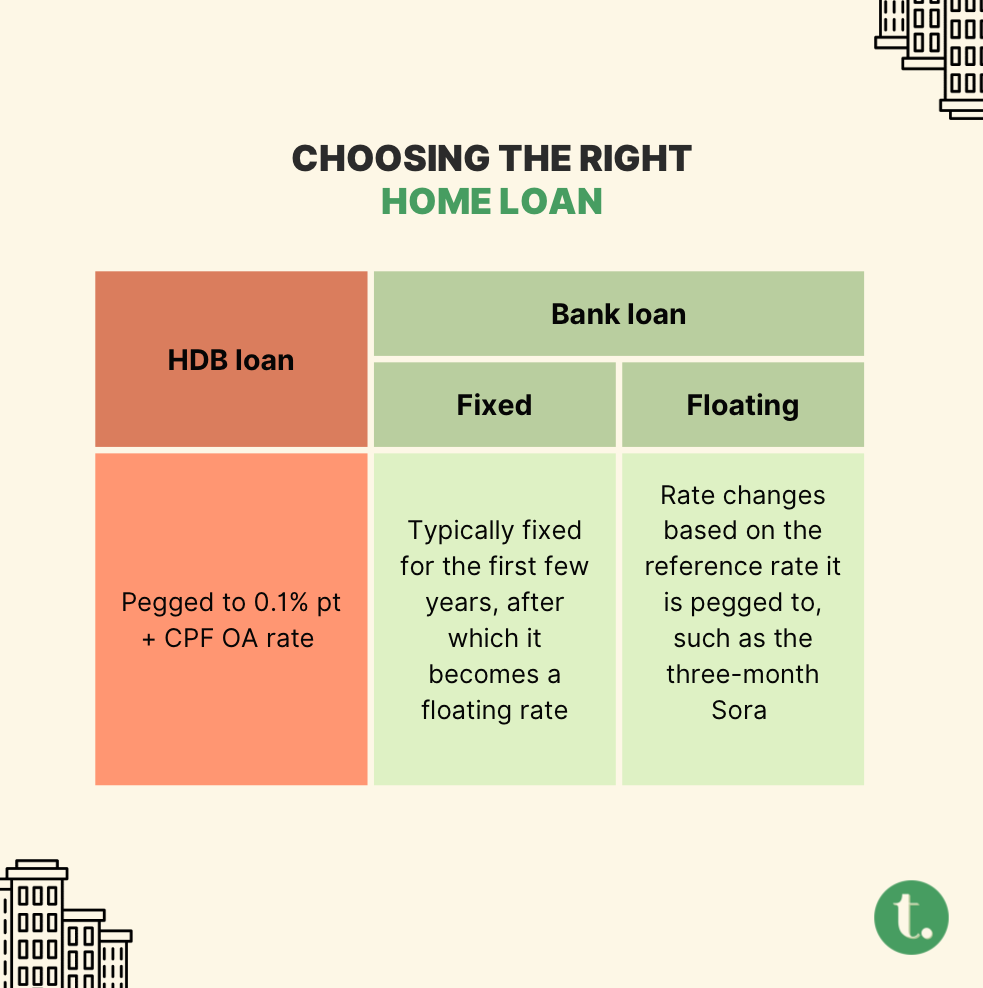

But like bubble tea from different outlets, housing loans aren’t all the same. If you’ve ever shopped around for a loan, chances are you’d be inundated by the choices available. Here’s a run-down of the common types of loans available.

🏠 HDB housing loan

HDB flat buyers can take up a loan from HDB that’s not available to private home buyers. The interest rate on this loan has stayed at 2.6 per cent for years. That’s because it’s pegged at 0.1 percentage point above the prevailing CPF Ordinary Account rate, which has remained at 2.5 per cent.

Pros:

Interest rate rarely changes

You can switch from a HDB loan to a bank loan, but not the other way around

Smaller down payment, which can be paid using CPF savings

Cons:

Can take up to two times only

At least one applicant must be a Singapore citizen

Monthly household income cannot exceed S$14,000 for families

🏦 Bank loan

Banks offer two main types of home loans: fixed-rate loans and floating-rate loans (also called variable-rate loans).

Fixed-rate loans have interest rates that remain the same for the first few years (typically two to five years). After a set number of years, the interest rate becomes variable. Currently, Singapore banks offer rates of around 3.3 to 3.75 per cent per year.

Floating-rate loans have rates that change depending on the market conditions. They’re usually tied to a reference rate.

Among the most common of these reference rates is the three-month Sora, which refers to the three-month compounded Singapore Overnight Rate Average. This rate reflects the actual transactions between banks in the unsecured overnight interbank SGD cash market here, and it’s updated every business day on the MAS’ website.

Banks typically add a spread to the Sora rate when offering a housing loan. For example, they could offer a floating-rate loan of the three-month Sora rate “+1 per cent”. If the rate stood at 3.7 per cent, this translates to an interest rate of 4.7 per cent for the loan.

Other reference rates include:

One-month Sora

The bank’s fixed-deposit rate

The bank’s board rate, which is set internally by the bank

The one-month Sora is more volatile than the three-month option. This is because the three-month Sora is based on a compounding period of three months of the historical Sora rate. If interest rates keep rising, the three-month rate is a better option. If rates continue to fall, the one-month Sora rate is ideal.

Bank loans can also come with special features. For instance, some loans won’t charge you if you pay off portions of the mortgage ahead of time, which can be a viable option for those who want to pay whenever they receive their annual bonus.

👇 Which to choose?

With interest rates this high, there’s no doubt that taking up a HDB loan is the most attractive option at the moment, mortgage broker Clive Chng tells Thrive.

That’s provided you’re eligible: Couples earning more than S$14,000 a month combined, or those who are permanent residents buying a resale flat, for example, will not be able to take up a HDB loan.

And if interest rates fall and bank loans become cheaper, there’s always the option to switch to a bank loan, adds the associate director at Redbrick Mortgage Advisory.

As for whether that will happen, Chng expects the US Federal Reserve to keep interest rates high for longer. This comes as Fed chair Jerome Powell said on Aug 25 that the central bank may need to raise rates further to ensure inflation is contained. In that case, going with a fixed-rate bank loan would be a good move for those ineligible for a HDB loan.

Some economists, though, expect the Fed to cut interest rates next year, so it might also make sense to take up a floating-rate loan in anticipation of falling rates.

But it’s hard to predict how interest rates will move. That is why Chng believes homebuyers should choose their loans based on how much risk they can handle.

If you are considering taking up a fixed-rate loan, make sure you have the means to pay your mortgage bill for the lock-in period.

As for floating-rate loans, Chng advises homebuyers to simulate how much they would have to pay every month if interest rates were to go up by 1 or 2 percentage points.

If the higher interest payments mean the homeowner will struggle to pay their monthly expenses, then it probably isn’t wise to speculate on future interest rates by going with a floating-rate loan.

In that case, “just fix your interest rate at your current level so it won’t affect your cash flow”, he says. “Most importantly, don’t default on your loan.”

TL;DR

Interest rates have risen at a blistering pace as central banks try to stem inflation

Banks offer two types of home loans: fixed rate and floating rate

HDB also offers a fixed-rate loan only for HDB homebuyers

When choosing, don’t speculate on a floating-rate loan if you can’t take the risk

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Yen tumbles to 34-year low; US dollar gains after inflation data

Fed repricing gives rise to new equities playbook in Asia

Dasin Retail Trust’s creditor to repossess director’s properties over loan default

Is Jurong Island’s carbon test bed too small and conservative? A*Star institute head thinks not

Tech rally propels emerging stocks to best week since July

Bank of Singapore takes action against employees for misusing medical benefits