Sats comes out on top in latest Asean Corporate Governance Scorecard

GROUND-HANDLER and in-flight caterer Sats has emerged top out of 100 Singapore publicly-listed companies in the 2019 Asean Corporate Governance Scorecard (ACGS) - jumping 10 places from its 11th position in 2017 - in results announced on Monday.

Held biennially, ACGS is part of an initiative under the Asean Capital Markets Forum, a high-level grouping of capital market regulators. Apart from Singapore, countries that participated in the latest assessment include Indonesia, Malaysia, Thailand, the Philippines and Vietnam.

The domestic ranking bodies of each country assessed a list of top 100 publicly-listed companies by market capitalisation in their jurisdictions, whereby the top 35 companies from each country then underwent peer review assessment randomly by the domestic ranking bodies of the other countries.

The final scores of these companies were derived after discussion by the ranking bodies, producing a list of companies in Asean that had achieved a minimum score of 75 per cent out of 130 points, a list of the top 20 companies in Asean, and a list of the top three companies in each country.

Across the region, banking group AMMB Holdings placed among Malaysia's top three, while Bank CIMB Niaga was one of the front-runners for Indonesia. (see amendment note)

Philippine property developer Ayala Land, Thai petroleum and energy conglomerate Bangchak Corporation and Vietnamese information technology company FPT Corporation were among the three highest scorers in their respective countries.

A NEWSLETTER FOR YOU

Asean Business

Business insights centering on South-east Asia's fast-growing economies.

Locally, the National University of Singapore (NUS) Business School's Centre for Governance, Institutions and Organisations (CGIO), as well as the Singapore Institute of Directors (SID), made up the domestic ranking body. The two have been appointed by the Monetary Authority of Singapore as the Republic's domestic ranking body for the Asean Corporate Governance Initiative since 2013.

In a joint statement on Monday, CGIO and SID said that Singapore companies "put in a strong showing" this year, with 26 companies scoring at least 75 per cent of the total attainable 130 points.

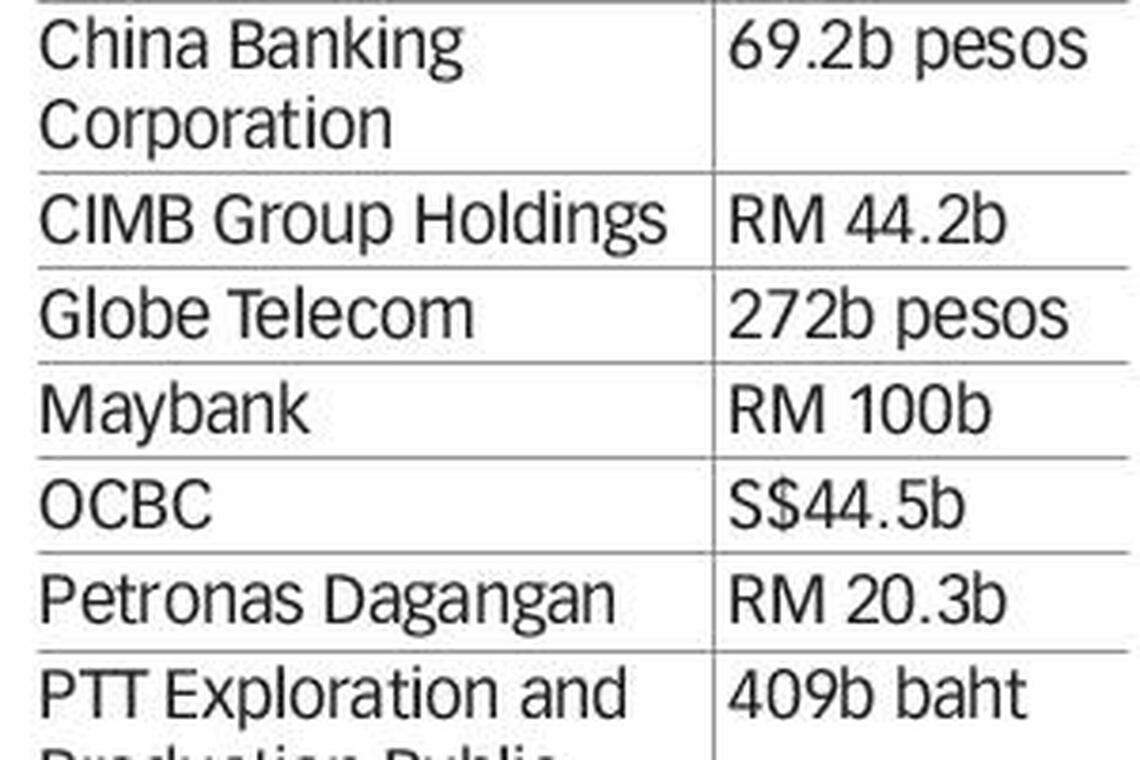

Coming in behind Sats' lead with 119.7 points were UOB and the Singapore Exchange, followed by Singtel in fourth place and OCBC in fifth.

On average, Singapore companies scored 88.3 out of 130 points, the highest score to date.

John Lim, chairman of the corporate governance benchmarks committee at SID, said: "It is most encouraging to note the significant improvement in average scores for Singapore's top 100 companies in the latest assessment, and we commend them on this achievement."

Across Asean, companies in Thailand had the highest average score of 96.6 points, followed by Malaysia with an average of 95 points. Companies in the Philippines scored an average of 77.2 points, along with Indonesia at 70.8 points and Vietnam at 54.6 points.

The ACGS scores comprise two sections of Level 1 and Level 2 scores. The Level 1 score is given based on five components: rights of shareholders, equitable treatment of shareholders, role of shareholders, disclosure and transparency, as well as responsibilities of the board.

Under the Level 2 scores, bonus and penalty points are awarded accordingly.

For instance, bonus points are awarded when a company has a policy and discloses measurable objectives for implementing its board diversity and reports on progress in achieving its objectives; penalties are given when there have been cases of non-compliance with the laws, rules and regulations pertaining to material related-party transactions in the past three years.

Companies in Singapore had recorded higher scores across all five components in Level 1 as compared to 2017, with scores in the role of shareholders increasing the most at 2.4 points, while equitable treatment of shareholders increasing the least at 0.1 points.

However, Mr Lim noted that companies "should be able to do even better with greater disclosures of their corporate governance practices", adding that "good disclosure" is an area where local companies have "lagged" some of its Asean counterparts in recent years.

Of the top 20 publicly listed companies across Asean, Malaysian companies dominated the list - taking up a total of seven spots. Singapore companies came in second at five, while Thailand and the Philippines tied at four companies each.

Lawrence Loh, director of CGIO, NUS Business School, said: "As a member of the Asean market, it is important for Singapore to push the corporate governance standards of Asean as a bloc, so as to increase the attractiveness of Asean to global investors."

The ACGS was developed by a group of regional corporate governance experts from the domestic ranking bodies, with seed funding from the Asian Development Bank.

It is a tool for Asean companies to improve their corporate governance practices and increase their visibility and investment attractiveness to global investors, and can be used by regulators as a reference for reviewing rules and guidelines to enhance corporate governance practices.

Amendment note: An initial version of this article stated that the companies across Asean emerged first in their respective countries, but they are only among the top three; the top scorers for each country will only be revealed at a later date. The article has been amended to reflect this change.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Suntec Reit Q1 DPU down 13% to S$0.01511 in absence of capital distribution

Sheng Siong Q1 net profit up 9.3% on higher revenue

Great Eastern chairman appeals for patience as shareholders fume over share price ‘disaster’

Changi Airport’s Q1 passenger movements surpass pre-pandemic levels

S&P Global first-quarter profit beats estimates on strong product demand

Malaysia mulls over plans for casino in Forest City as part of Johor-S’pore Special Economic Zone: sources