Move over, Paris and Milan: Luxury brands pivot to Asia-Pacific as China splurges

LED by China, Asia-Pacific (APAC) markets are now grabbing the brightest spotlight in global luxury retail, with the region overtaking industry favourite Europe in physical store openings for the first time.

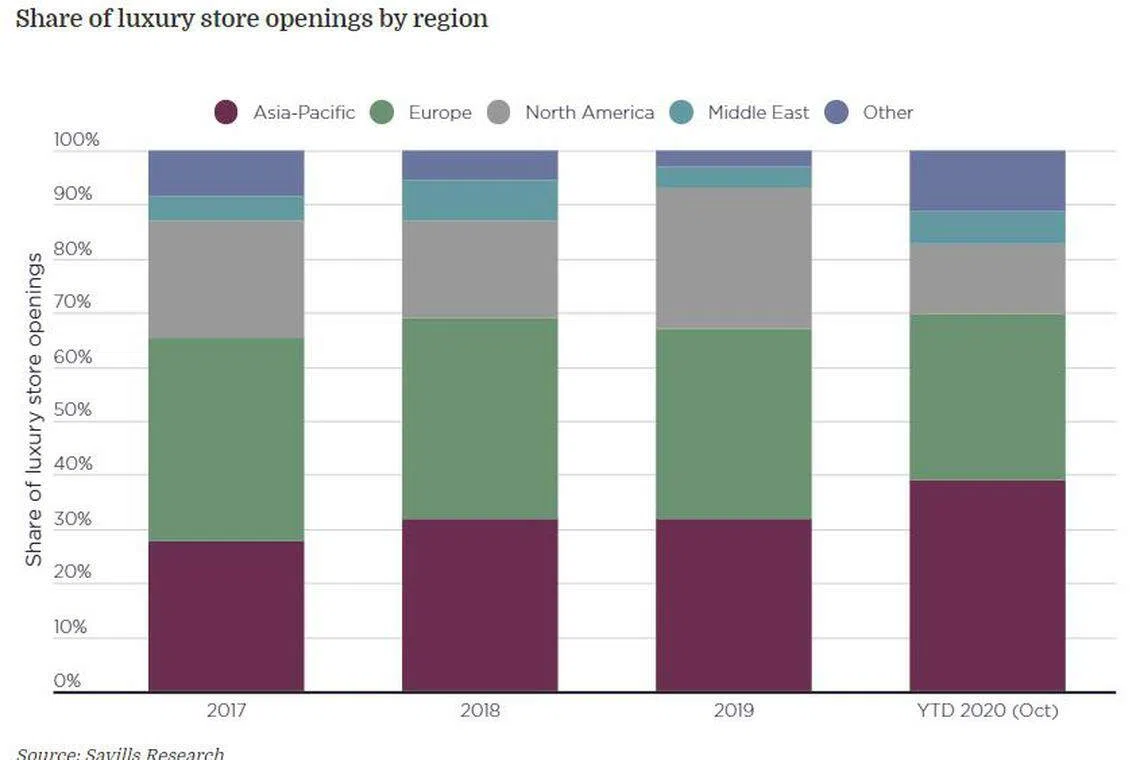

From January to October this year, APAC snagged the biggest share of luxury store openings - 38.9 per cent - compared to other regions.

That exceeds APAC's 31.8 per cent share for the whole of last year, according to data from real estate services provider Savills.

"For a number of years, APAC has provided luxury brands with a key contribution to their global business," said Anthony Selwyn, head of Savills' prime global retail team.

Now, the region is recovering from the coronavirus pandemic, "stimulating further aggressive expansion and investment", he added.

APAC's bigger share of brick-and-mortar openings was largely fuelled by retailers expanding their physical footprint across China, which saw a jump in spending and a rebound in domestic tourism amid pandemic-related global travel restrictions.

SEE ALSO

A NEWSLETTER FOR YOU

Asean Business

Business insights centering on South-east Asia's fast-growing economies.

China accounted for 18.8 per cent of luxury store openings worldwide in the year to date, almost half of the region's share and far outstripping the country's previous three-year average of 6.4 per cent.

And compared with 2019's full-year levels, China saw a 64.7 per cent surge in openings in just the first 10 months of this year, making it the only major market to grow over this period.

Many retailers this year expanded their presence in the country to meet demand for luxury products, "particularly at a time when Chinese tourists are largely unable to travel long-haul to traditional retail destinations such as London, Paris and Milan", wrote Savills.

Domestic tourism has also recovered rapidly in China following the country's lockdowns in the first quarter. Further boosting Chinese consumers' spending was the Golden Week holiday in early October.

The Greater Bay Area - including Hong Kong, Shenzhen, Macau and Guangzhou - has been particularly active in terms of openings since the easing of lockdowns, welcoming 11 per cent of new stores globally in the year to date.

"All luxury brands have an eye on the Greater Bay Area as an area of tremendous growth," said Nick Bradstreet, managing director of the Savills Hong Kong retail agency team. He noted that the central government is also targeting the area to become a technology and financial powerhouse to rival California's Silicon Valley by 2035.

Key openings of late in the Greater Bay Area included Burberry's first digital-centric "social retail store" in Shenzhen in partnership with tech giant Tencent, allowing customers to interact digitally with products through QR codes and WeChat.

This is an example of brands successfully interacting with consumers through digitally innovative concepts, and will likely shape the configuration of physical stores around the world in the future, according to Savills.

Singapore has experienced a similar trend of domestic spenders coming out in full force to splurge.

Given that luxury boutiques in Singapore had for years depended heavily on Chinese tourists, "it came as a bit of a surprise" when long queues were seen outside major luxury stores in the Republic during its phased reopening, said Sulian Tan-Wijaya, executive director and head of retail and lifestyle at Savills Singapore.

"Singaporeans, unable to travel during the pandemic, have been contributing to brisk sales at Chanel, Louis Vuitton, Cartier, Dior and many more," Ms Tan-Wijaya added.

Moreover, Singapore is fast emerging as a hub for sneakers - a newcomer in the luxury market - as more brands hop on the bandwagon for this "highly lucrative" segment. "Recent collaborations like Dior X Nike Air Dior sold out worldwide at S$3,500 a pair and quickly surfaced online at resale prices of S$12,500," she said.

Meanwhile, on the other side of the world, Europe took a smaller piece of the pie of global physical store openings in the year to date, compared to its market-leading share of close to 40 per cent it commanded in 2019.

Long seen as a heavyweight in the luxury industry, Europe - along with the US - continue to see a resurgence in Covid-19 cases, prolonged economic downturns and job uncertainty.

As a result, the global luxury market is expected to shrink by up to 45 per cent year on year in 2020, based on Boston Consulting Group's (BCG) latest forecasts.

In contrast, China's spending on luxury goods in 2020 could surge to 30 per cent above last year's levels, despite the country's temporary store closures earlier this year, according to BCG. Bain & Co has also predicted that China could contribute half of the world's luxury spend by 2025.

"Ensuring that your brand has an excellent profile in China will therefore be a matter of survival for many luxury retailers," Mr Bradstreet said.

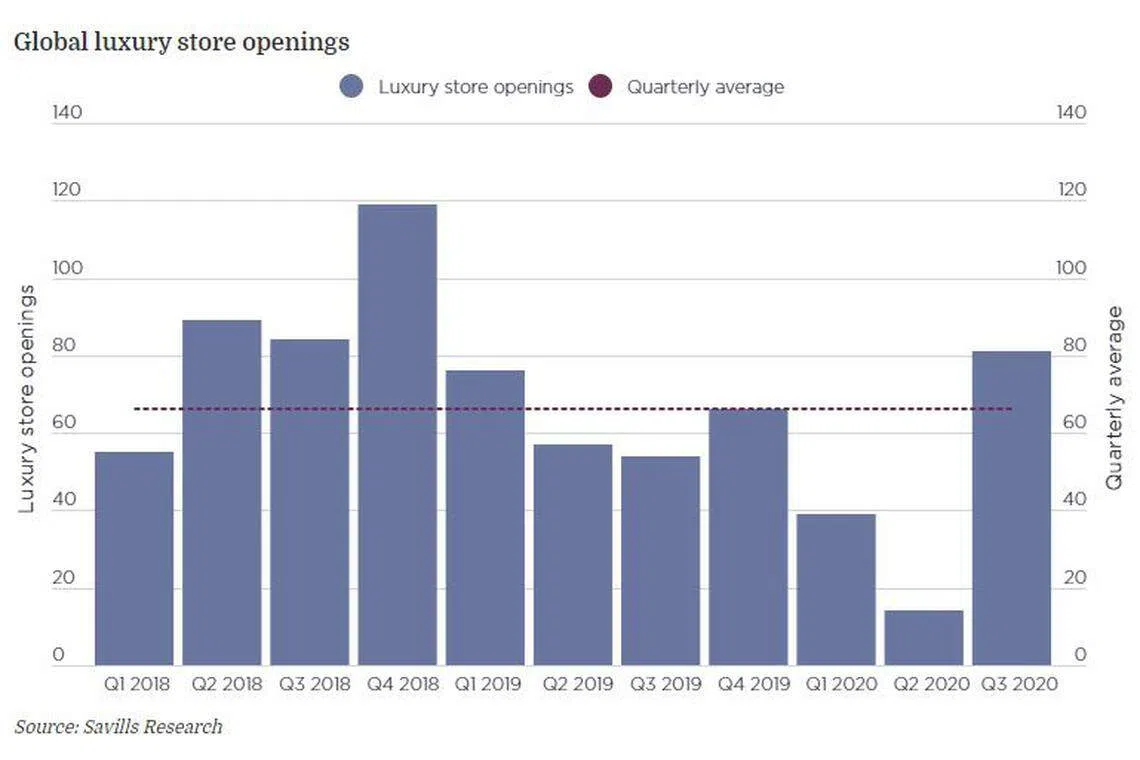

Savills noted that from July to September this year, there was a "strong bounce back" in global physical store openings, exceeding the quarterly average.

This followed global lockdowns which had stalled openings during much of the first half of the year, with many brands now rethinking their retail investment in light of Covid-19-related headwinds.

Mr Selwyn added that while luxury sales in APAC are surging, this is still a hugely challenging time for the industry, and other regions that are less profitable will see an increase in store closures.

However, innovative retailers that are able to pivot their offer and reach new audiences to capitalise on local demand will likely thrive and reap the rewards in terms of growth, Mr Selwyn said.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Consumer & Healthcare

Gazelle Ventures makes cash offer for No Signboard shares at S$0.0021 apiece

P&G raises annual core profit forecast on resilient demand, price hikes

Cordlife calls for trading halt after shares sink to all-time low, pending announcement

Marina Bay Sands Q1 profit surges 51.5% to US$597 million on tourism boom

Swiss watch exports plunge as China and Hong Kong demand dries up

Cutting the cord?: Events leading up to Cordlife’s MOH suspension and arrests of its directors, ex-group CEO