Global fixed income market still heavy on carbon-intensive financing

The study also flags the hidden nature of some “carbon-intensive” debt instruments

FINANCING heavy emitters remains a key feature of the global fixed income market, with almost a third of non-financial corporate debt issued by carbon-intensive companies and their related entities, a study by the London Stock Exchange Group (LSEG) has found.

This comes as the adoption of green bonds remains low within carbon-intensive sectors.

About 29.5 per cent of non-financial corporate debt outstanding as at June 2023 – amounting to US$5.5 trillion – was issued by companies in carbon-intensive sectors and their related entities, LSEG said in its study released on Friday (Mar 22). This surpasses the value of debt of any other non-financial sector.

The study identified about 480,000 corporate debt instruments issued by companies in the energy, transport and industrials and materials sectors, as well as related entities that fall outside these carbon-intensive sectors. It refers to such instruments as “carbon-intensive debt”.

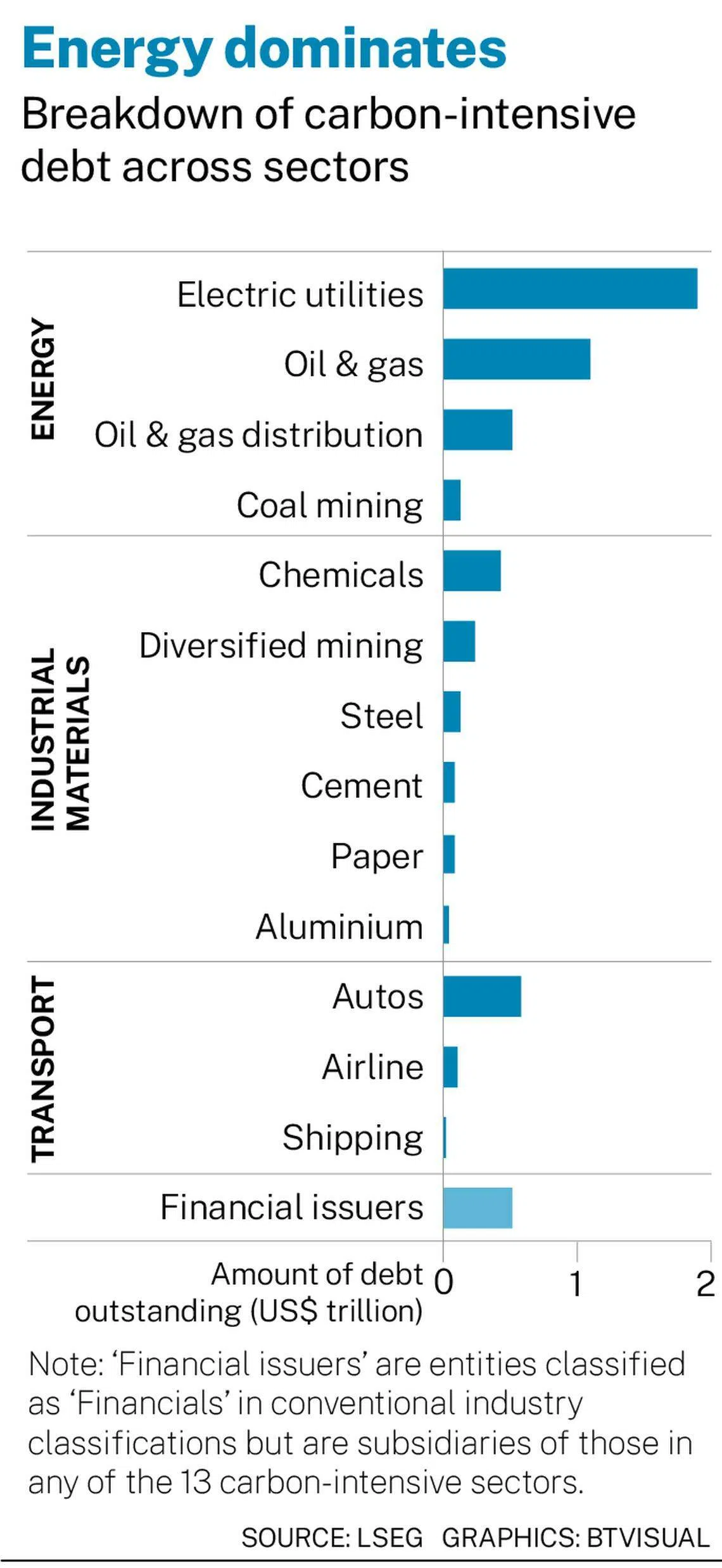

Energy players dominated the issuances. The sector accounted for about two-thirds of the US$5.5 trillion sum, particularly in the electric utilities (US$1.9 trillion) and oil and gas (O&G) (US$1.1 trillion) segments.

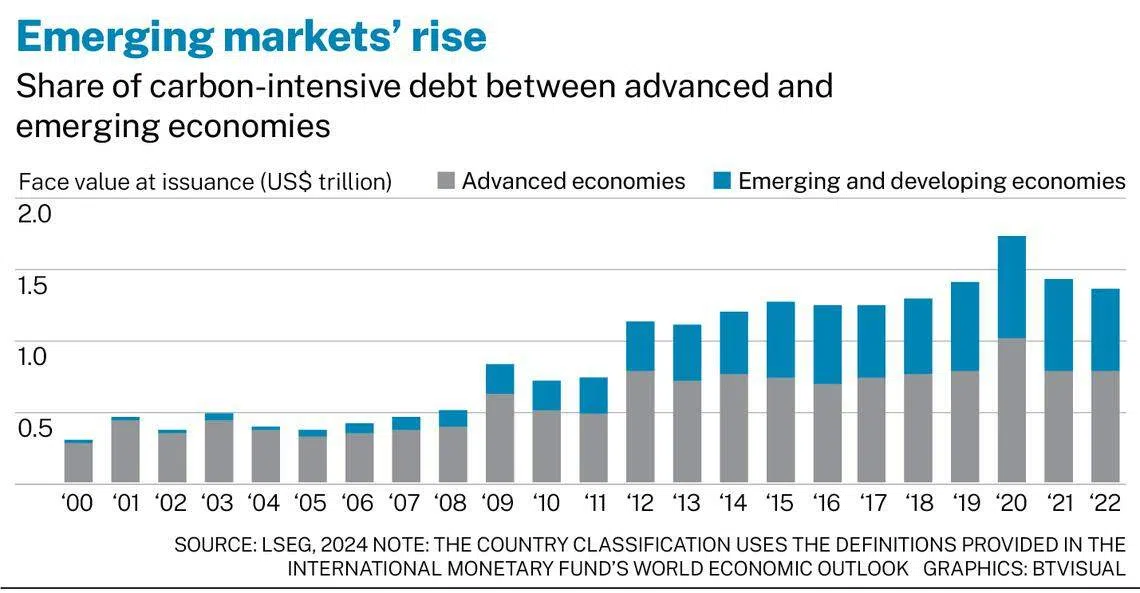

The study also found that emerging markets are playing a bigger role in financing heavy emitters. The share of carbon-intensive debt from emerging markets increased from 4.1 per cent in 2000 to 41.3 per cent in 2022.

A NEWSLETTER FOR YOU

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

Hidden debt

The study flagged the obscure nature of some carbon-intensive debt. Of the 480,000 carbon-intensive corporate debt instruments identified, over 84,000 were “hidden” securities issued by subsidiaries and special purpose vehicles outside of carbon-intensive sectors.

“(Assessing) securities purely based on the sector classification of the issuing entity can overlook debt from entities that are commonly classified as ‘financials’ or other sectors that are usually not considered as carbon-intensive,” the report noted.

In addition, almost two-thirds of the US$5.5 trillion sum is owed by private companies (US$2.1 trillion) or state-owned enterprises (SOEs) (US$1.5 trillion) – exceeding the US$1.9 trillion owed by listed companies.

Both private companies and SOEs are typically subject to much less scrutiny than listed companies, “whose transition plans are often closely tracked by investors and other stakeholders”, the report said.

It added: “Compared to the overall corporate fixed income market, however, many institutional investors’ holdings may have significantly less exposure to carbon-intensive debt, raising questions about potential ‘carbon leakage’.”

Carbon leakage refers to when regulatory pressure causes emissions-heavy activities to be displaced to entities with less stringent standards.

Other features of carbon-intensive debt

Separately, the study found that carbon-intensive debt securities tend to be larger, with an average issuance size of US$235 million. In contrast, other non-financial corporate debt has an average size of US$185 million.

Some of the largest carbon-intensive bonds include the 15-year, US$14.9 billion bond issued by the Aluminium Corp of China in 2017; and the US$8 billion, 30-year bond issued by Petroleos Mexicanos in 2020.

Carbon-intensive debt also tends to come with a longer tenure. Of the US$5.5 trillion in carbon-intensive debt, 46 per cent was issued with a maturity of 10 years or longer, and 16 per cent with a tenure of over 30 years – compared to 39 per cent and 12 per cent, respectively, for other non-financial corporate debt.

That said, the weighted average tenure of annual carbon-intensive debt issuance has dropped from 7.4 years in 2010 to 4.2 years in 2022. This suggests that carbon-intensive issuers are relying more on shorter-term debt to finance their activities, the report said.

The study further noted that carbon-intensive debt tends to be better rated. Some 59 per cent of the outstanding carbon-intensive debt is investment-grade, compared to 50 per cent in other non-financial corporate debt.

“For carbon-intensive debt with a 15-year-plus tenor, the share of investment-grade rises to 78 per cent – not least because issuers of longer-term debt are typically seeking credit ratings to assure investors of their ability to fulfil the financial obligations over a longer horizon,” the report said.

Refinancing challenge

Refinancing carbon-intensive debt poses “increasingly urgent and complex challenges” to investors and issuers, the report noted. Over half, or US$3.2 trillion, of carbon-intensive debt is set to mature before the end of 2030, including US$931 billion in electric utilities and US$669 billion in O&G debt.

Carbon-intensive issuers’ transition plans are likely to influence their refinancing strategies, the report said. At present, the issuance of green bonds is still low in carbon-intensive sectors, accounting for only 8.2 per cent of 2022 issuance and 7.7 per cent of the sectors’ total outstanding debt.

Green debt is especially limited in the O&G, aluminium and airline sectors, where green issuances amount to less than 1 per cent of each sector’s total outstanding debt.

But moving forward, issuing labelled green or transition bonds could be a more appealing option.

“These bonds not only signal an issuer’s commitment to decarbonising its business model, but also help attract investors who may otherwise hesitate to take on exposure to carbon-intensive assets,” the report said.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

ESG

Why decarbonisation is so hard

Basel Committee adds climate risks to banking supervision standards

Temasek-BlackRock joint venture closes inaugural decarbonisation-focused fund at US$1.4 billion

As COP29 planning begins, reforms needed to fulfil Paris ambition

How should investors assess climate transition risk in their portfolios?

Climate court ruling could set precedents in Europe and beyond