F&B players seek rebates as some face imminent closure from outbreak

Singapore

THE Restaurant Association of Singapore (RAS) has asked major landlords for rental rebates to tide its members over this difficult period, when their takings have plunged by as much as 80 per cent following the novel coronavirus (Covid-19) outbreak.

With 200,000 food and beverage (F&B) jobs at risk, RAS had, earlier this week, written to 24 major landlords including CapitaLand, Frasers and Mapletree, seeking rental rebates of 50 per cent from February to April.

Among the first landlords to step up is Jewel Changi Airport, which has taken the initiative to offer its F&B and retail tenants a 50 per cent rebate on fixed rent from Feb 11 to April 10, said RAS president Vincent Tan, who is also the managing director of Select Group.

But analysts told The Business Times that not all companies will see the same degree of damage wrought by the epidemic; high-end ones will feel the heat more than their mass-market peers, which are likely to be more resilient.

Mr Tan told reporters on Thursday that rental and labour costs make up about 55 per cent of operating costs, and that the industry's net profit margin is razor-thin - an average of 1 to 1.5 per cent.

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

In a snap poll among 302 RAS members, nearly 60 per cent said they were not prepared or equipped to deal with this outbreak, and that measures to address rental and labour costs were the two most sought-after reliefs.

Andrew Tjioe, RAS president adviser and chief executive officer (CEO) of Catalist-listed TungLok Restaurants (2000), said: "You can see how most of our landlords are performing financially: There's imbalance in distribution of income. Many of us operate in Reited malls. Rent there has been increasing year by year, and it's a very heavy burden."

He urged the landlords to ride out the storm with their tenants as partners: "If we can't survive, they also can't survive."

Of the few landlords who have already responded, some told RAS that they prefer to talk to their tenants individually.

Others would rather shorten operating hours, step up marketing efforts - such as by offering free parking to attract footfall - or wait for the government's announcement of budget help measures on Feb 18 before deciding.

Mr Tan complimented Jewel the landlord for the gesture "that will go a long way in helping us save the livelihood of our employees", and expressed hope that other landlords would follow suit.

Without immediate help, closures of some F&B establishments will be imminent, RAS warned.

Major shopping mall landlords in Hong Kong are offering cuts in February rent by as much as 60 per cent to help tenants ride out the effects of the coronavirus outbreak.

RAS has also approached the government for assistance with labour costs, rents and working capital.

In the meantime, some RAS members have either put staff on unpaid leave or stopped calling their part-timers in for work.

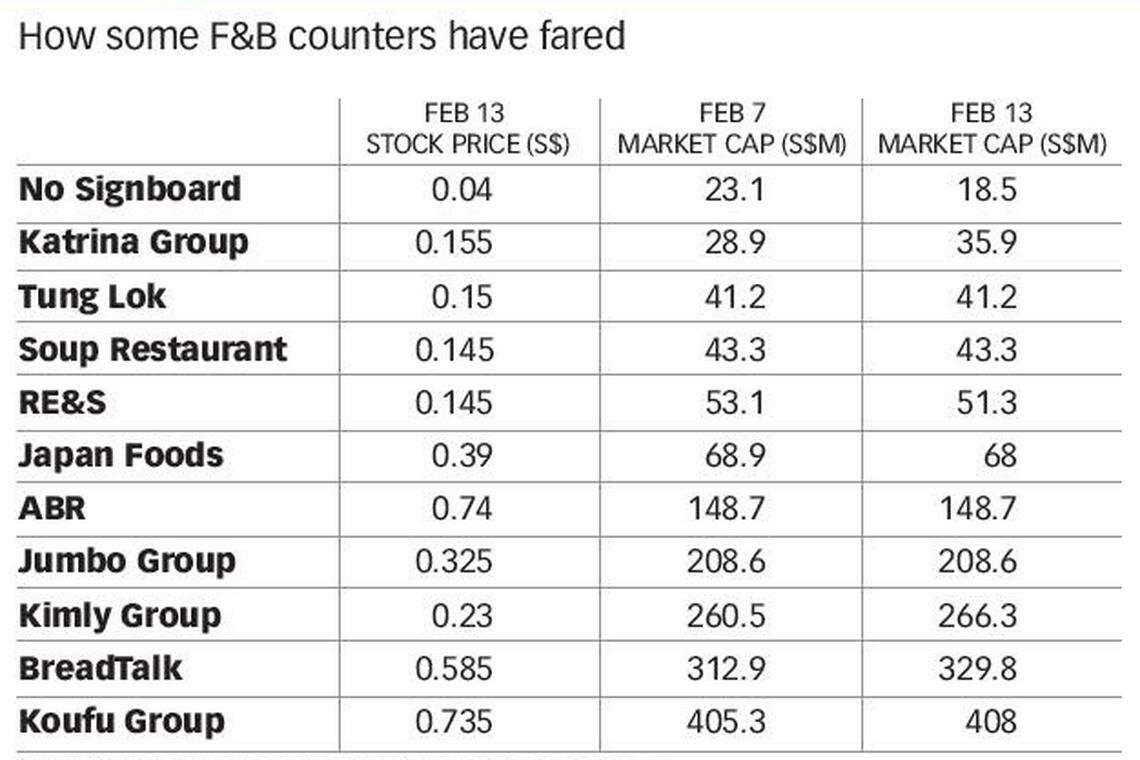

DBS analyst Alfie Yeo told BT that high-end, full-service restaurants will take the first hit, followed by mid-priced restaurants, and lastly, lower-end food courts and hawker centres. Jumbo, BreadTalk then Koufu, in that order of seeing the most impact, he said.

Ong Khang Chuen, CGS-CIMB analyst, said that dining format and exposure to Greater China are factors determining the impact on the F&B players. "I expect full-service restaurants to suffer more than the mass-market dining options, as consumer spending could further dampen during this period of uncertainty."

The analyst, who counts Jumbo Seafood restaurants in Singapore as the only F&B player he covers, noted its reliance on tourists, especially those from North Asia, and on business dining. "We can thus expect recent travel restrictions on tourists from China to hurt its footfall," he said.

"Also, its China operations account for about 18 per cent of its total revenue, so we expect the company to be hit harder than peers which are more domestically focused."

Carmen Lee, OCBC Investment Research head, noted the share prices of several restaurant operators, including Japan Foods, have declined in the year to date, with the dips ranging from 6 to 22 per cent.

Juliana Cai, RHB Securities Singapore analyst, believes that Kimly, among the F&B players the brokerage covers, would be the most resilient as its business is limited to Singapore. "We believe sales are likely to be held up with a rise in takeaways and delivery services, even as dining out declines."

Kimly is one of the largest traditional coffee shop operators in Singapore.

Players exposed to China can expect their China retail business to be hit: BreadTalk draws 30 per cent of its revenue from China and Hong Kong, and Jumbo, 20 per cent from China.

"The Singapore operations for these two companies are also likely to be affected as locals avoid gatherings and dining out, with Jumbo seeing a greater impact due to its reliance on tourists."

When approached by BT, major retail landlords including Lendlease, Frasers Property and Far East Organization (FEO) said they are looking at possible measures to support tenants.

A spokesman from Frasers Property's retail unit, which runs malls including Waterway Point and The Centrepoint in Orchard Road, said supportive measures "will be rolled out progressively, as and when the need arises".

The group is also working with tenants facing "manpower challenges" to adjust their operating hours on a case-by-case basis.

Jean Hung, Jewel Changi Airport Development's chief executive, referring to the introduction of support measures to provide temporary cost relief for its tenants, said: "These efforts are a demonstration of the close partnership we have with our tenants... Jewel's continued growth and development is very much dependant on our partnership with our tenants, and we strongly value the contributions our tenants have made towards turning Jewel into a vibrant destination since its opening."

READ MORE: HK property developers cut retail rents amid war on virus

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

Oil prices steady after Iran plays down reported Israeli attack

G7 pledges swift aid for Ukraine, seeks to calm Middle East

H5N1 strain of bird flu found in milk: WHO

China moves to boost foreign investment in domestic tech companies

Xi orders China’s biggest military reorganisation since 2015

Warner Bros CEO earned US$49.7 million in strike-impacted year