Singapore Oct factory output beats expectations with 4% growth

Analysts see last month's figures as harbinger of fourth-quarter growth momentum

Singapore

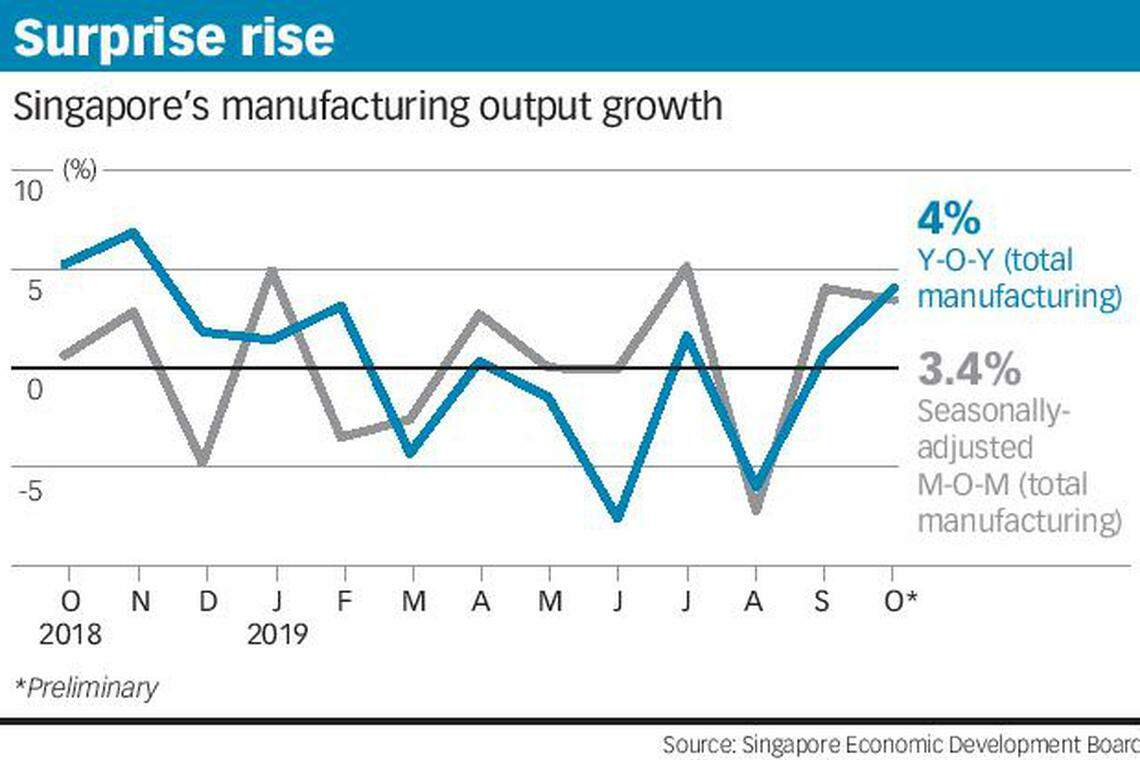

SINGAPORE'S factory output grew an unexpected 4 per cent year on year in October, defying economists' expectations of a 1.4 per cent fall and outstripping September's revised figure of 0.7 per cent growth.

Even excluding the volatile biomedical manufacturing sector, output was up 0.2 per cent, according to Singapore Economic Development Board figures on Tuesday.

OCBC Bank head of research and strategy Selena Ling saw October's figures as "a positive harbinger" for fourth-quarter growth momentum.

On a seasonally adjusted month-on-month basis, manufacturing output was up 3.4 per cent, slowing from September's revised 4 per cent rise but still ahead of economists' expectations of 0.6 per cent growth. Excluding biomedical manufacturing, output was up 6.5 per cent.

Biomedical manufacturing continued to be the main driver, up 24 per cent year on year in October. Pharmaceuticals were up 29.6 per cent, while medical technology output rose 13.1 per cent on the back of higher export demand for medical devices.

General manufacturing rose 7.3 per cent, with growth in food, beverages and tobacco as well as miscellaneous industries more than making up for an 11.8 per cent fall in printing.

Precision engineering output rose 3.4 per cent, with a 1.7 per cent fall in machinery and systems more than made up for by 9.9 per cent growth in precision modules and components.

Electronics emerged from decline with 0.4 per cent growth. Output rose for computer peripherals, data storage and infocomms and consumer electronics, though semiconductors and other electronic modules and components still declined. In the first 10 months of the year, electronics output was down 6.5 per cent from the same period last year.

Still, Maybank Kim Eng economists Chua Hak Bin and Lee Ju Ye noted that the important semiconductors segment was "almost back into positive territory", with its 0.9 per cent fall in October having eased from September's steep 13 per cent decline.

Barclays economist Brian Tan said the strength in electronic products was encouraging but "its durability still needs to be monitored".

Transport engineering output was down 2.4 per cent. A 21 per cent growth in aerospace output could not make up for a 4.8 per cent drop in the land segment and a 22.8 per cent fall in marine and offshore engineering.

Chemicals performed worst in October, down 9.6 per cent, with only petroleum seeing a 3 per cent rise. Maintenance shutdowns in both the specialities and petrochemicals segments resulted in contraction of 12.4 per cent and 12.8 per cent respectively. Other chemicals fell 3 per cent.

The Maybank economists said that manufacturing could emerge from recession earlier than expected, in the fourth quarter rather than next year.

They kept their 2019 gross domestic product (GDP) growth forecast at 0.9 per cent, but upgraded their 2020 forecast to 1.8 per cent, up from 1.6 per cent. "We think the manufacturing recovery is on a firmer footing, as the impact from the US-China tariff shock dissipates," they said.

With the global Purchasing Managers' Index (PMI) - a leading indicator of manufacturing sentiment - bottoming out in July, they expect Singapore's PMI to also bottom out and rise out of contraction by early next year.

UOB economist Barnabas Gan said that growth in Singapore's semiconductor-related industries such as electronics and precision engineering may be led by improving sentiment over US-China trade talks and expectations of global recovery.

UOB expects full-year industrial production to contract by 0.5 per cent, better than a previous estimate of a 3 per cent fall. This would mean a 2.1 per cent growth in industrial production in the fourth quarter, adding upside risk to their full-year GDP forecast of 0.5 per cent.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

Singapore factory output reverses into negative territory in March, down 9.2%

Singapore’s growth should strengthen to ‘around potential rate’, output gap to close by end-2024: MAS

Gan Kim Yong visits US and Canada; to mark 20th anniversary of US-Singapore FTA

NTUC aims to do more to support PMEs, who now account for nearly half its membership

Daily Debrief: What Happened Today (Apr 25)

Singapore’s inflation eases more than expected in March, with headline inflation at 2.5-year low