Singapore poised for K-shaped recovery following Q3 rebound

IT, advanced manufacturing, financial services likely to lead the way, add economists

Singapore

A K-SHAPED recovery for the Singapore economy seems the most likely outcome, with IT, advanced manufacturing and financial services leading the way, while other sectors are likely to suffer a more prolonged impact, economists told The Business Times (BT).

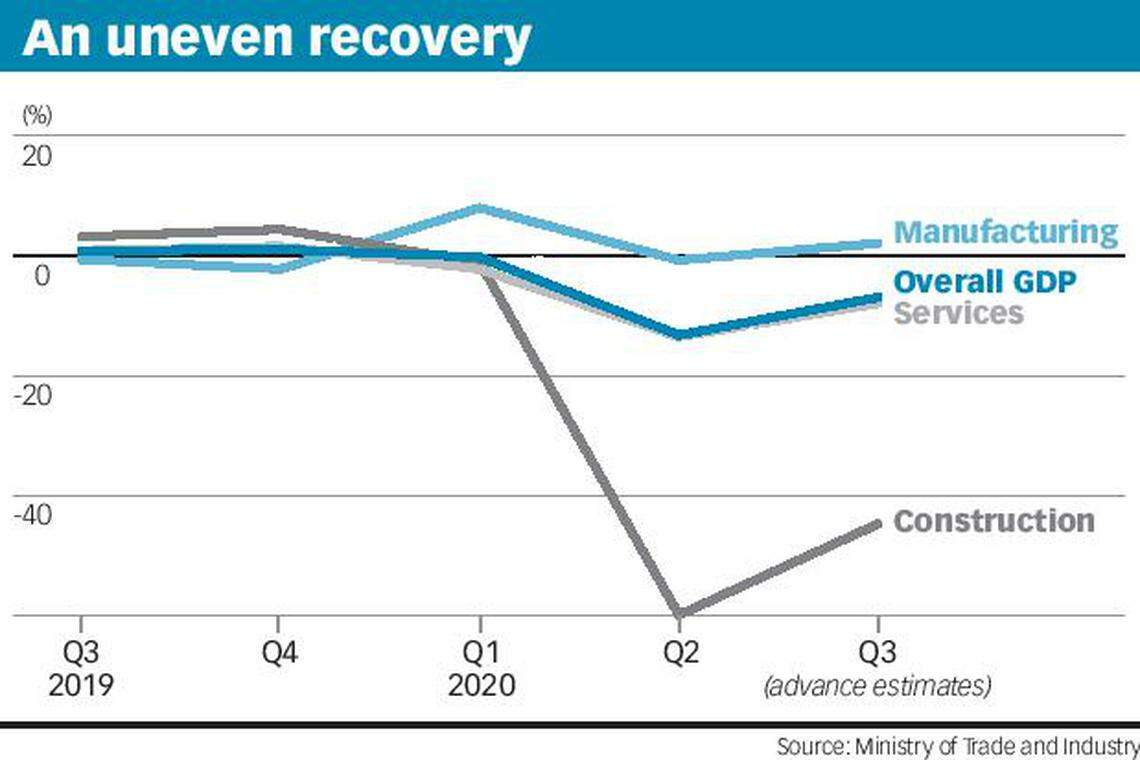

Singapore's third-quarter economic contraction shrank more slowly at 7 per cent year on year, an improvement from the 13.3 per cent contraction seen in the second quarter, according to advance estimates by the Ministry of Trade and Industry. On a quarter-on-quarter seasonally-adjusted basis, gross domestic product (GDP) grew by 7.9 per cent in Q3, staging a dramatic rebound from the 13.2 per cent contraction clocked in Q2, when Singapore was on a partial economic shutdown due to the Covid-19 pandemic.

Q3's performance was mostly lifted by manufacturing, the only sector that expanded, with a 2 per cent growth. This was offset by the construction and services sectors, which saw quarter-on-quarter gains but remained in contraction on year-on-year basis.

Nonetheless, economists were mostly in agreement that Q3 marks the start of Singapore's economic comeback since the trough in Q2, although recovery will be uneven. In other words, it will take the form of a "K shape".

"The recovery will come to different industries at a different pace, and it will also feel very differently to different segments of the society," DBS senior economist Irvin Seah told BT.

A NEWSLETTER FOR YOU

SGSME

Get updates on Singapore's SME community, along with profiles, news and tips.

For example, the manufacturing sector made a strong and rapid recovery, emerging to become the main driver of growth in Q2 and Q3, Mr Seah said. At the same time, the construction sector spent several months in the doldrums, while recovery is still "not in sight" for the hospitality and aviation sector, he added.

For now, prospects look positive for the technology, financial services and manufacturing sectors, which are poised for expansion. But there is also a darker aspect to the K-shaped recovery, economists warned, one that highlights a widening income gap.

Maybank Kim Eng senior economist Chua Hak Bin said the uneven recovery has resulted in "divergent fortunes" between lower- and higher-income households. "The pandemic recession has a disproportionately large negative impact on the lower-wage workers. Most of the services sectors' hardest hit - retail, F&B, recreational, tourism, hospitality - employ workers earning wages below the overall average," Dr Chua noted.

Mr Seah said while the high-income group may have felt the recovery with the rebound in the equity market, lower-wage or displaced workers likely have not felt any recovery yet.

Although the worst is believed to be over, there may still be job losses and business closures in the coming quarter.

OCBC chief economist Selena Ling said they are likely to be concentrated in those industries that have not been allowed to resume yet, such as entertainment spots and clubs, although other sectors facing significant pressure from the lack of consumer demand - including tourism, retail and aviation - may not be spared.

On the bright side, some economists are hopeful that a possible Phase 3 reopening in the fourth quarter can support economic recovery, and Ms Ling believes Q4 GDP is likely to contract a milder 1.3 per cent year on year, with full-year GDP shrinking 5.5 per cent.

UOB economist Barnabas Gan is predicting a 5.2 per cent contraction for Q4, with full-year GDP declining 6.5 per cent.

"The possible move to allow more people to attend social events would likely benefit Singapore's food and beverage, wholesale and retail trade and hospitality-related services. In a nutshell, Phase 3 will be largely beneficial for the services sector, which accounts for over 60 per cent of GDP," said Mr Gan.

However, both DBS's Mr Seah and Maybank's Dr Chua believe Phase 3 may only bring an incremental economic benefit to lift growth, with the bigger boost coming from a relaxation of border controls. He said his full-year GDP forecast of -6 per cent implies a Q4 contraction of 3.4 per cent.

Meanwhile, Mr Seah is expecting a Q4 contraction of about 5 per cent, with full-year GDP shrinking 6.5 per cent.

Barclays regional economist Brian Tan is predicting a full-year GDP contraction of 6 per cent given that the economy shrank by 6.9 per cent year on year in the first three quarters of 2020.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

An economy transformed: Lee Hsien Loong’s 20 years as Singapore’s Prime Minister

Daily Debrief: What Happened Today (Apr 18)

Singapore’s first RoboCluster launched for facilities management, to turn R&D into market solutions

Daily Debrief: What Happened Today (Apr 17)

Singapore’s key exports on track for recovery despite March’s surprise 20.7% tumble: economists

Employers must process all flexi-work requests from Dec 1