Forging a more inclusive digital future with DBS Foundation

As Singapore’s digitalisation drive picks up speed, the foundation is working to ensure no one gets left behind

THE world has been radically transformed since the advent of the Internet. People are ever-more interconnected, and information now travels at speeds that were unimaginable just 50 years ago.

Singapore’s digitalisation drive has likewise accelerated, with the introduction of schemes such as the Infocomm Media Development Authority’s (IMDA) DigitalAccess@Home and Singapore Digital programmes.

Today, 99 per cent of resident households in the city-state are connected to the Internet, and 97 per cent of the population own smartphones.

For those born into these buzzing times, navigating the digital world may seem like second nature. But for those who have had to grapple with a constantly evolving landscape, the increasing prevalence of digital platforms in everyday life can be daunting.

To ensure that no one is left behind in Singapore’s digitalisation journey, DBS Foundation has developed a range of community-centric programmes, with the goal of bridging the gap for non-digital natives.

“We’re living in a world that’s rapidly digitalising,” said Monica Datta, head of the foundation’s Community Impact Chapter (CIC). “It is imperative that we bring the less digitally savvy along with us by providing them with the necessary skills and guidance, and empower them to stay ahead of change too.”

A NEWSLETTER FOR YOU

Lifestyle

Our picks of the latest dining, travel and leisure options to treat yourself.

The CIC was set up in 2022 as a broadening of DBS Foundation’s efforts to help communities become more food secure, as well as to uplift underserved groups through upskilling.

That second objective is where DBS Foundation’s suite of digital literacy programmes comes into play. “It is our hope that by helping them to pick up key digital skills, we’re also helping them to face the future with more confidence,” said Datta.

Expanding its reach

DBS, as a bank, has long been focused on improving digital literacy among Singapore’s communities. Now, with the CIC, DBS Foundation is ramping up its efforts to equip seniors with the digital skills required to navigate digital technologies in everyday life.

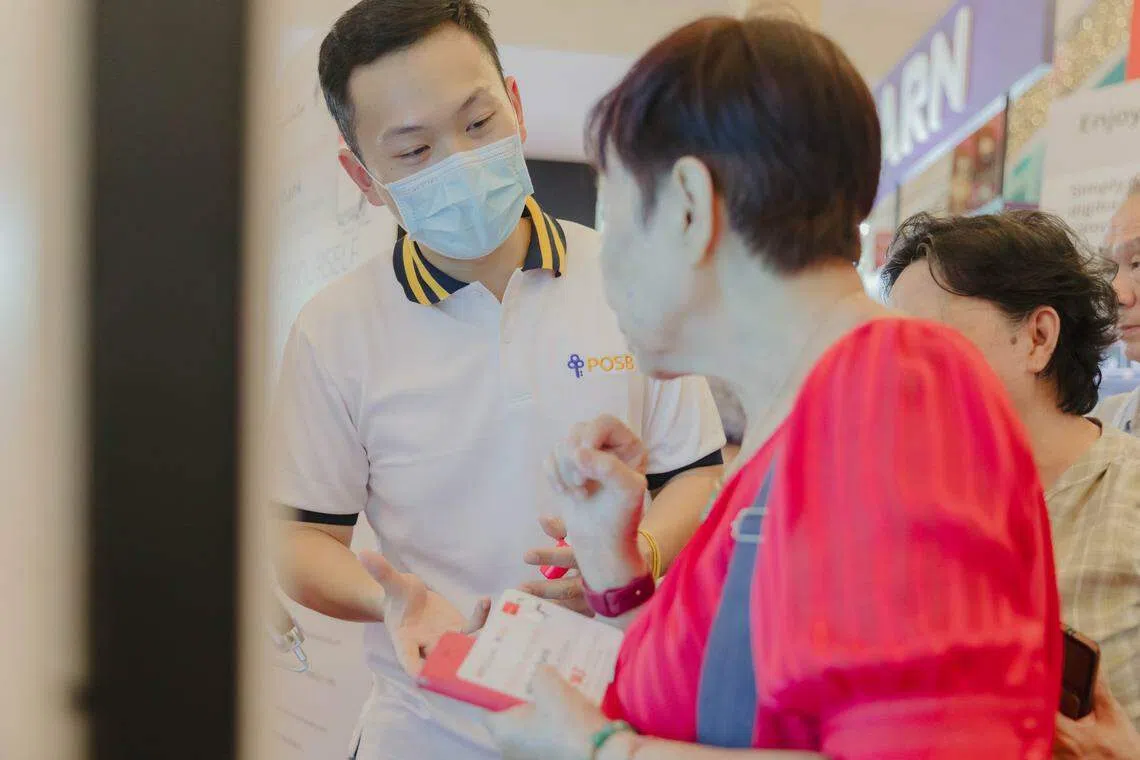

For instance, POSB has been running digital literacy workshops since 2012, in collaboration with partners such as IMDA, Touch Community Services and the People’s Association. These have involved supporting and educating seniors on digital banking and payments, among other activities.

Separately, through DBS’ employee volunteerism movement, People of Purpose, the bank has worked with community organisations such as Lions Befrienders to boost digital literacy for low-income seniors in Singapore through educational workshops.

The partnership with Lions Befrienders has already benefited some 1,000 seniors to date. Alex Lim, chairman of the social service agency, said: “Partnering with DBS and DBS Foundation has enabled Lions Befrienders to reach out and benefit more seniors through the wide network of DBS volunteers and their range of curated programmes.”

In support of the Digital for Life movement, the foundation in 2022 began a strategic partnership with IMDA, aimed at driving digital inclusion in Singapore with a targeted reach of 100,000 beneficiaries over two years.

As part of the two-year partnership, DBS Foundation is contributing S$1 million, inclusive of dollar-for-dollar matching by the government, to the Digital for Life Fund, which gives grants for digital inclusion projects and activities.

In addition, at least 2,500 DBS employees will run 800 digital workshops on digital banking and payments, as well as scam detection and avoidance. For individuals who are more comfortable with over-the-counter services, some of these sessions will be held in select DBS and POSB branches.

Over 400 of these workshops have been run to date, benefiting some 59,000 individuals.

Collaborating with partners such as IMDA and Lions Befrienders is a key tenet of DBS Foundation’s approach to driving digital inclusion. “By working with like-minded partners… we hope to create a digitally inclusive Singapore where no one is left behind,” said Datta.

“We also hope more will come onboard this shared journey, to join us in driving collective change and being more impactful together.”

Education meets innovation

DBS Foundation is also exploring new ways of teaching seniors digital skills.

In August and September, the foundation and POSB organised a series of five digital literacy roadshows, featuring getai as a medium for edutainment. The performances, held at hawker centres across Singapore, were paired with digital literacy workshops, to encourage hawkers and elders to pick up new skills.

More recently, during IMDA’s Digital for Life Festival from October to November, DBS Foundation piloted an aerobic dance workout, Tap Tap Dance, which featured an original song with lyrics based on online banking skills and scam awareness.

Wendy Chua, a senior associate in DBS’ consumer banking group, was part of the team that developed the workout.

She said she was inspired to empower the elderly through digital literacy after seeing that her mother-in-law had learnt to use cashless payments.

“I thought seniors might be hesitant to learn new things and prefer to rely on others for assistance,” said the 32-year-old. “Now I know that there is a group of seniors out there who are so eager to learn.”

Chua and her team found that a direct and interactive approach would be the most effective in helping seniors learn. “I realised that (they) absorb information better when (it is) straight to the point. Having fun is a universal language, and we thought a catchy song and dance can assure them that online banking is simple with just a few taps.”

They wrote the song that accompanies Tap Tap Dance, which includes lines about transactions that can be performed through DBS’ digital banking platform, digibank, such as updating one’s personal particulars, opening an account and transferring funds.

Helen Lim, 73, who took part in the workout, said: “Now, when I hear the lyrics, especially ‘tap, tap’, it reminds me that – like the younger folks – I too can stay in touch with the latest digital skills.”

Through Lion Befrienders and DBS employees, she has learnt to – and now regularly uses – cashless payments, such as when buying food at hawker centres.

Not easily fooled

Beyond general digital literacy, DBS Foundation has also been working to improve resiliency against online scams in Singapore.

Data from the Singapore Police Force (SPF) published in September showed that in just the first six months of 2023, there were 22,339 scams reported; this was a 64.5 per cent increase from the corresponding period in 2022.

New forms of scams are constantly being created on a range of platforms, from messaging apps to e-commerce websites.

As these malicious actors come out with increasingly sophisticated scams, the fight against such cyber-enabled crimes in Singapore has intensified. A key element of this is ensuring that all segments of society – covering everyone from digital natives to newbies – are equipped with the knowledge to detect and avoid online scams.

To this end, DBS Foundation in September launched an anti-scam quiz and cybersecurity tips in collaboration with the Cyber Security Agency of Singapore.

Some 3,000 people have been engaged through this initiative, with 82 per cent reporting a higher level of confidence in banking digitally after going through the quiz and tips.

DBS Foundation is working to expand the rollout of this initiative, by integrating it into the various digital literacy workshops it conducts, and through channels such as the bank’s community outreach efforts.

It is also exploring integration with its People of Purpose programmes, so more beneficiaries under its partners can also pick up anti-scam knowledge.

While those who are younger may be better able to detect scams online, a poll by the Ministry of Communications and Information found that just 44 per cent of those aged above 60 are confident in identifying scams on messaging platforms.

With this in mind, DBS Foundation expanded the scope of its digital literacy programmes for seniors to include anti-scam and cybersecurity workshops.

Datta noted that even with a strong framework for improving digital literacy, seniors can still struggle to learn.

“For many participants, a key challenge that’s holding them back from adopting digital skills lies in the uncertainty of embarking on something unfamiliar. Simply providing access to digital tools and skills isn’t enough.”

A group of volunteers providing the human touch is key to enact tangible change, she added.

“What’s more important is to have people there to guide and hand-hold them, till they gain the confidence to move forward on their own.”

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Lifestyle

Former Zouk morphs into mod-Asian Jiak Kim House, serving laksa pasta and mushroom bak kut teh

Massimo Bottura lends star power to pizza and pasta at Torno Subito

Victor Liong pairs Aussie and Asian food with mixed results at Artyzen’s Quenino restaurant

If Jay Chou likes Ju Xing’s zi char, you might too

Mod-Sin cooking izakaya style at Focal

What the fish? Diving for flavour at Fysh – Aussie chef Josh Niland’s Singapore debut