Investors re-entering real estate, eyeing debt, logistics, living sectors

For long-term growth, investors are watching emerging technologies, data centres and disruptors like AI

Change and uncertainty have challenged industries around the world during the post-pandemic recovery, and seem likely to persist in the new year amid geopolitical conflict.

Many economists have looked to commercial real estate (CRE) as a key economic indicator to assess collective performance during these fluctuating economic times. With US$3.1 trillion in real estate assets globally having maturing debt by the end of 2025, it’s not surprising why.

On the heels of price adjustments in commercial property since the onset of tightening rate policies, global advisory firm JLL reports that the equity shortfall for these loan maturities at refinancing could be between US$270 billion and US$570 billion.

A recent Global Capital Outlook report from JLL finds that as we begin 2024, well-capitalised investors, particularly private investors, have a compelling first-mover advantage to seize as the world continues to navigate inflation, interest rate volatility, tighter lending standards and elevated price uncertainty.

A future in the CRE capital markets headlined by credit strategies and diversification becomes strikingly apparent when one digs beyond the current debt figures.

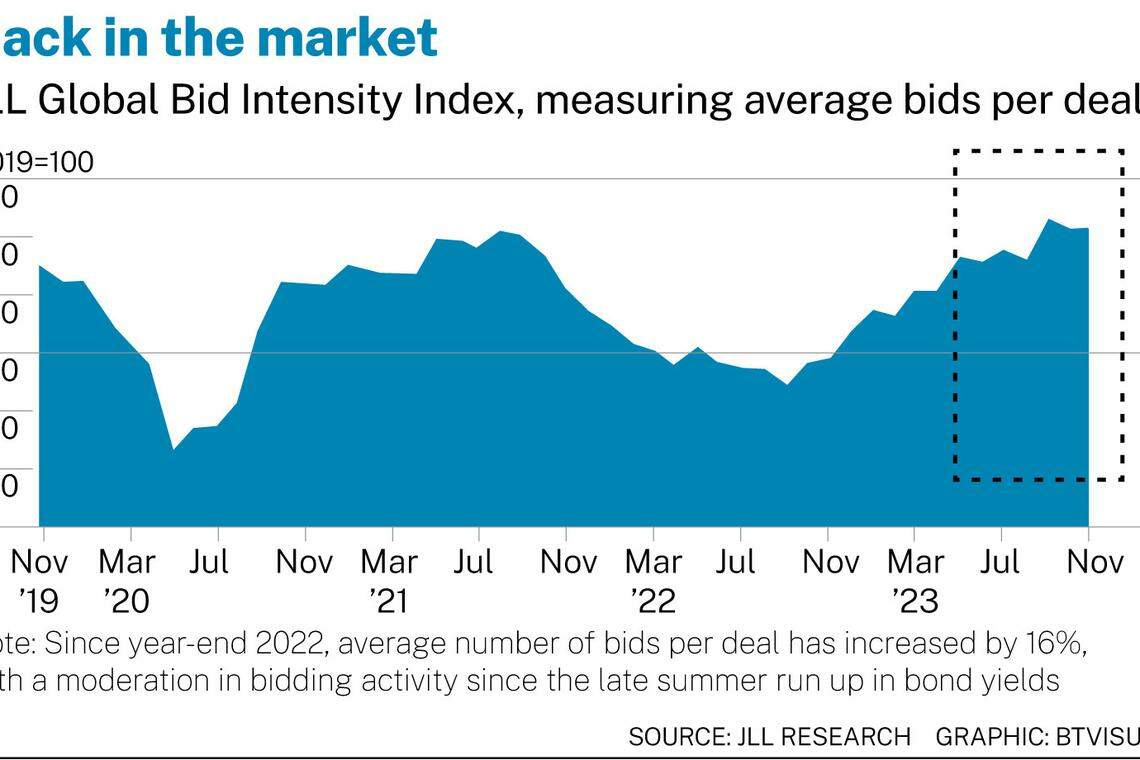

According to JLL’s proprietary Bid Intensity Index, a growing number of bidders began re-entering the market last year, accentuated by private credit vehicles from private equity funds, individual investors and select institutional investors like sovereign wealth funds.

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

Not only has the source of capital flows expanded, the direction of investment has also broadened.

Recent investment activity, from both new private sources and more familiar ones, shows a widening of the CRE sector investment aperture.

In the elevated interest rate environment, investors have embraced debt strategies, raising US$110.7 billion over the past three years across more than 330 closed-end funds and accounting for approximately 16 per cent of CRE fundraising, according to data from Preqin. This makes sense in a period of elevated interest rates, given the absolute yield potential of these credit strategies.

Debt is one diversification strategy, but sector diversification remains top of mind for investors as well.

The shift in portfolio strategies that began in the decade leading up to the pandemic continues today, as investors look for opportunities to capture near- and long-term growth categories, as well. As a result, near-term growth is expected to be strongest in the logistics and living sectors.

Collective exposure to the logistics and living asset classes across the largest core funds globally has increased 263 per cent since 2016, and now accounts for some 52 per cent of core fund exposure in Asia, 62 per cent in the US and 46 per cent in Europe.

In the Asia-Pacific, for example, logistics accounts for 38 per cent of core fund exposure (up from just 11 per cent in 2016), driven by the region’s continuing e-commerce boom amid urbanisation and dense, large population centres.

Within the living sector, capital is strongly focused on the multi-family/build-to-rent, student housing and single-family rental sectors as cities around the world grapple with housing affordability challenges.

Overall, US$1.4 trillion is expected to be deployed into living strategies globally over the next five years. By 2030, we expect a third of annual real estate investment will occur in the living sector.

For long-term growth, investors are keeping an eye on emerging technologies and disruptors like artificial intelligence (AI), robotics, advanced manufacturing and infrastructure, which are expected to increase demand for a new genre of research and development, manufacturing and distribution facilities.

We’re already seeing increased demand for more data centres, with growth limited only by supply shortages.

Renewable energy to support these facilities through wind, solar and hydro sources will also require CRE infrastructure, presenting investment opportunities. While specialist players dominate this space in many markets, these areas are increasingly attractive to large institutional, cross-sector investors due to their long-term growth potential.

While some of these strategies are new or still emerging in CRE, the long-term attractiveness of real estate as an asset class has remained steady. From a 10-year return perspective, CRE has consistently proven its value and stacked up well against other asset classes, in part due to its lower volatility and lower correlation to other asset classes.

And as long as people inhabit the earth, we will require spaces to work, live and play, which is a good reminder that real estate is so much more than simply an asset. It’s where the economy happens and is fundamental to human life on this planet.

Richard Bloxam is chief executive officer of JLL Capital Markets

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Seoul to unveil property debt measures next week

Hong Kong’s new home sales hit record high of US$5.4 billion

Chinese cities lift curbs on buying homes as property crisis bites

Shophouse sales surge and at higher prices in Q1 as high-net-worth investors return: Knight Frank

UK home sellers rush to put property on market after prices dip

Manhattan apartment rents climb to highest on record for April