Is the Singapore office market turning?

Weaker economic growth, tech slowdown, hybrid-working trend weigh on leasing demand

Singapore’s office market has demonstrated extraordinary resilience since the onset of Covid-19, weathering the initial phase of the pandemic in 2020 before recovering strongly in 2021-2022 along with the easing of restrictions and rebound in economic growth.

The government’s forward-looking policies and agile response to the pandemic have played a key role in the recovery. To promote business continuity, workplace measures were gradually eased to facilitate a full return to office from April 2022.

This had a positive knock-on effect on office demand, with islandwide office vacancy falling to a record low of 5 per cent by the end of 2022. Core CBD (Grade A) rents also enjoyed a solid recovery, logging gains of 11.9 per cent during 2021-2022 and reversing the double-digit decline witnessed in 2020.

By Q3 2022, rents exceeded pre-Covid levels. During this period, numerous occupiers relocated and expanded their footprint, solidifying their presence in the Singapore office market, while several companies relocated some headcount from Hong Kong to Singapore to better position themselves for growth.

Following a hugely positive couple of years, recent months have brought some cautionary signs, including slower rental growth. Weaker economic expansion, a slowdown in tech sector demand and the new normal of hybrid working are among the challenges that could negatively impact leasing demand and threaten to put a lid on further growth of Singapore’s office market.

Slower economic growth

While Singapore is likely to avoid a recession this year, economic growth is forecast to lose momentum, with Oxford Economics projecting GDP growth to be just 0.4 per cent in 2023, a sharp deceleration from 2022’s 3.6 per cent. As office demand is intrinsically correlated to economic growth, leasing momentum is therefore expected to ease off as well.

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

Occupier caution, which has slowly set in since the end of 2022, could intensify over the remainder of this year as the high interest rate environment prompts more companies to focus on space optimisation and rightsizing to a more efficient footprint.

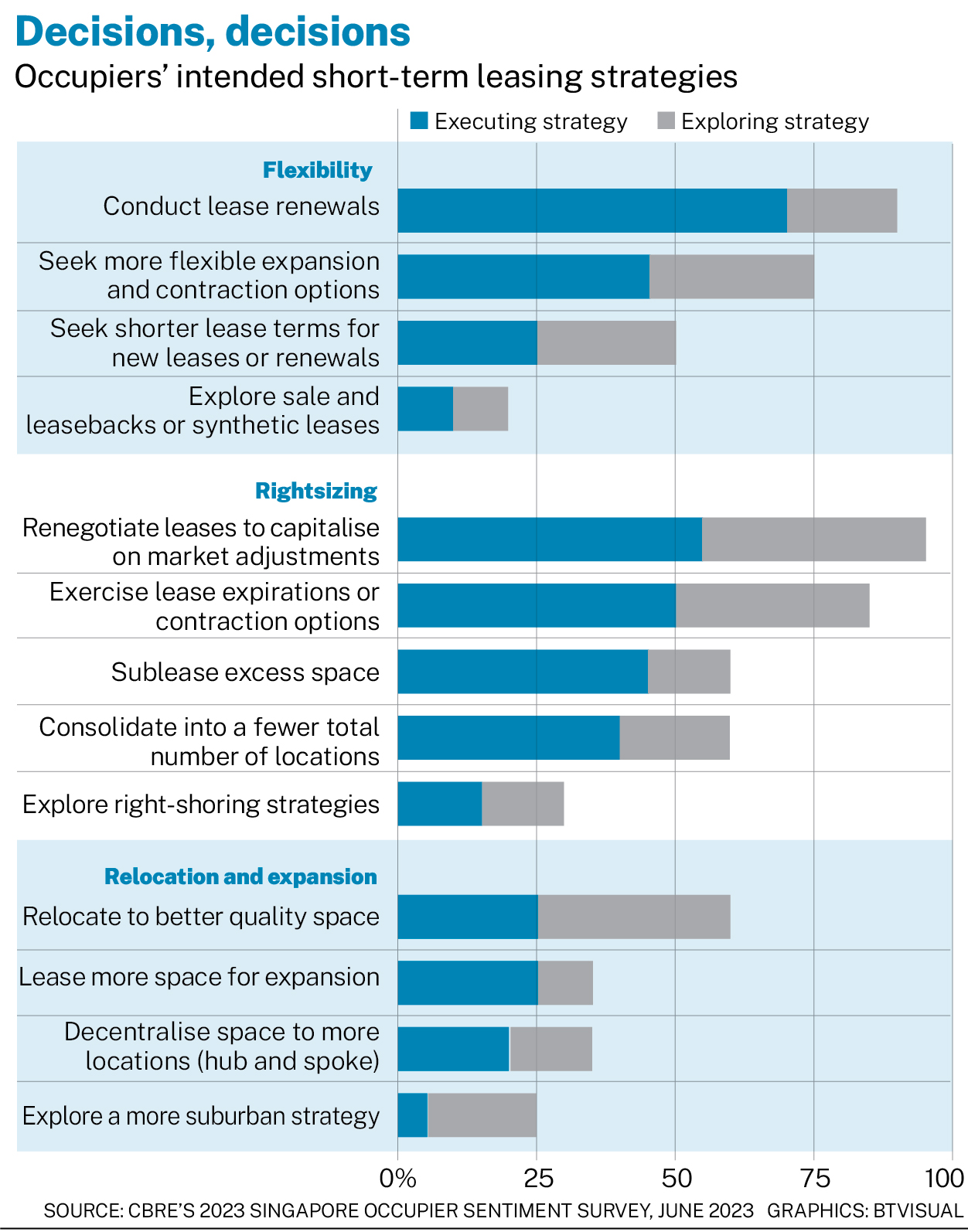

CBRE’s 2023 Singapore Occupier Sentiment survey found that companies expect to retain a conservative stance towards leasing in the short-term, with most respondents opting to focus on lease renewals and re-negotiations. Survey participants also named rightsizing and enhancing lease flexibility as other short-term priorities.

In addition, the substantial run-up in office rents witnessed during 2021-2022 is leading some occupiers to question whether Singapore’s business environment remains cost-competitive, which could weigh on leasing demand.

CBRE nevertheless expects office leasing demand in Singapore to remain positive in the long term as the country continues to provide good value compared to its Asia-Pacific counterparts.

Although the office rental gap between Singapore and Hong Kong has narrowed since the onset of the pandemic, prime CBD office rents are still more affordable in Singapore. With Singapore retaining its status as a global business hub, the office market will undoubtedly remain relevant and essential to sustaining the country’s economic growth and enhancing its appeal to major corporates.

Tech demand has weakened

Towards the end of 2022, a series of announcements from tech firms involving large-scale job cuts dampened office market sentiment. The tech sector accounted for 40-50 per cent of leasing transactions between 2019 and 2022, but this proportion has fallen significantly this year as cost containment measures have brought expansionary activity almost to a standstill.

An increasing number of tech firms have started to sublet parts of or, in some cases, their entire offices, resulting in a record amount of shadow space of 0.7 million square feet or about 1 per cent of total islandwide office stock as at March 2023.

The emergence of shadow space has created opportunities, however, with occupiers now able to lease fully-fitted space in prime CBD buildings. This enables tenants to reduce upfront capital expenditure and offers shorter lead times before they can commence office operations, resulting in substantial cost savings during their lease term.

As the tech sector stabilises and some fully-fitted shadow space gets taken up, the amount of shadow space has since halved to 0.33 million sq ft by September 2023.

Hybrid working here to stay

Despite it being three and a half years since the onset of Covid-19 and life having returned to normal, only a small proportion of companies in Singapore require staff to fully work from the office.

CBRE’s 2023 Singapore Occupier Sentiment Survey found that a clear majority of firms expect employees to equally split their time between working from home and the office. Office workers of all ages prefer and expect their employers to provide hybrid working policies that can facilitate a mix of in-office, remote, activity-based and hot-desking arrangements.

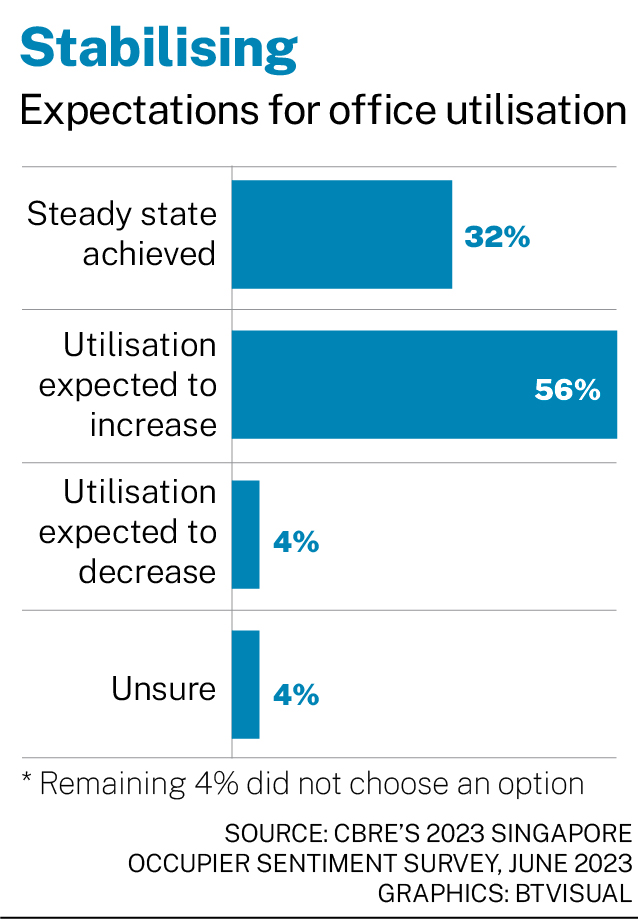

With office utilisation in Singapore averaging at about 65 per cent as at Q2 2023, there is potential for office usage to increase further. The same survey found that corporates plan to strengthen their efforts to lure staff back to the office by implementing more concrete workplace policies and strategies over the next six to 12 months.

However, office utilisation rates are unlikely to fully recover, with CBRE expecting office attendance to increase slightly but stabilise at 10 per cent to 15 per cent below pre-pandemic levels.

With employees spending less physical time in the office, companies will need to respond by recalibrating and rightsizing to a more appropriate and efficient footprint.

The structural impact of hybrid working will inevitably weigh on office demand, with historical net absorption of one million sq ft per annum unlikely to be achieved. That said, upcoming supply will be tight, with the 2023-2026 pipeline forecast to be 32 per cent below the average witnessed over the past 10 years.

Along with the potential removal of existing stock due to redevelopment, this should ensure tight overall occupancy rates even as demand and supply are recalibrated. The emphasis on employee experience and sustainability should continue to drive flight to quality and flight to greener buildings.

Market resilience through decentralisation

Despite the softer sentiment this year, the government pushed ahead to launch a tender for a Master Developer site at Jurong Lake District to propel the planned development of the second CBD. Envisioned to be developed in phases over 15 years, the site could potentially provide over 1.5 million sq ft of office space, while also including residential, retail and hotel components.

With the earliest completion likely in 2028, this supply is unlikely to impact the office market in the near term. If designed well, a decentralised CBD could enhance the competitive offering of Singapore as a business hub by providing different occupiers with greater choice of good quality office buildings at optimal price points. However, we feel this needs to be done hand-in-hand with continued rejuvenation and new greenfield developments in the CBD.

In a nutshell, while there are dark clouds still lingering, the Singapore office market should remain resilient and steadfast for the rest of the year. In the longer term, the strong fundamentals across the Singapore office market will help it to navigate through times of uncertainty as Singapore is well placed as a business hub, and the office sector will undoubtedly remain relevant to sustaining the city’s economic growth and attractiveness to major corporates.

David McKellar is co-head of office services, Singapore, and Goh Jia Ling is associate director of research, South-east Asia at CBRE

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

US renters seeing chance of owning a home at record low: NY Fed survey

Shenzhen eases home buying to revive sales in China tech hub

Far East Orchard looks to sell Rendezvous Hotel Perth Central for A$18.5 million

Lendlease Global Reit’s committed portfolio occupancy rises to 88.8% in Q3

No bids for Pine Grove’s mega en bloc sale at S$1.95 billion price

China home sales slump 47% over May Day holiday vs 2023